Ricky Shankar, Chairman of Clear Factor

How was inter-bank lending affected by the 2008 financial crisis?

In the aftermath of the financial crisis of September 2008, money market interest rates rose sharply and there was a virtual freeze in inter-bank lending. A principal source of funding for loans to businesses and individuals was no longer available.

SME’s were directly affected. These small businesses, more than any other, relied on bank debt including overdrafts and loans for their external financing needs and were particularly at risk from a collapse in bank lending. Indeed, the available evidence from 2008 suggests that small businesses were not only finding it increasingly difficult to obtain finance, but were dealing with the withdrawal of promised finance, experiencing sharp increases in loan interest rates and were having facility fees imposed. Even firms with good credit histories were not immune to these problems. Banks became more risk averse and small business owners were being offered smaller loans, as falling house prices meant they had reduced collateral.

What type of SME’s were affected?

Ricky Shankar launched his then software services firm Amsphere, in 2002 to help FTSE 100 businesses reduce their risk of business change, particularly in IT.

Like many entrepreneurs getting started, Shankar had put up his home as collateral with a high street bank – HBOS. Amsphere grew quickly and exponentially, posting 100% growth in revenue and profits. In 2005, Amsphere continued to expand and subsequently, payment terms lengthened. Yet, despite being profitable, cash flow was becoming an issue and Amsphere required access to working capital in order to pay the monthly bills.

Shankar looked in to invoice financing and within a few weeks agreed an invoice finance facility with HBOS. In short, Amsphere was able to draw down 85% of all invoices raised immediately. Their cash flow problems were solved at a stroke.

The next three years saw Amsphere’s trajectory further rise, peaking in 2008 when the firm was named in The Sunday Times fastest growing Techtrack companies in the UK. HBOS publicised Amsphere’s accolades and were quick to also take credit.

In 2009, as a direct result of the financial crisis, HBOS was taken over by Lloyds and they merged to become Lloyds Banking Group, the largest retail bank in the UK.

The following year, Lloyds recalibrated its risk assessment and Amsphere was now deemed ‘high risk’ despite being a reliable client and posting no bad debts. In no uncertain terms, Amsphere was given six months to find a new invoice finance lender.

Shankar quickly sought an alternative arrangement with Bibby Financial Services and a deal was signed. However, three days before the transfer between banks, Bibby pulled out of the deal, asking for directors’ homes as collateral. Amsphere, now struggling as many SME’s were in the recession, still remained profitable but was three days away from collapse.

Shankar contacted Simon Featherstone, who at the time was Managing Director of Lloyds Commercial Finance. A meeting with Lloyds was arranged whereby it was explained how the failings of banks would in effect be putting a perfectly profitable and fast growing UK SME out of business and Featherstone convinced Lloyds to take back Amsphere as a client.

Whilst Shankar’s predicament had a happy ending, thousands of other profitable businesses were not so fortunate. According to data from the Federation of Small Businesses, 50,000 small businesses fail each year due to cash flow issues.

So, is the Alternative Finance Marketplace changing?

“After my experience, I saw the opportunity for the invoice financing sector to grow away from the banks. There are almost six million small businesses in Britain today. Of those, less than one per cent are funded by high street banks!” added Shankar, who is now Chairman of Clear Factor, a transparent, democratised global invoice-finance ecosystem that provides every viable SME with access to fair and affordable working capital.

“SME’s today have very few choices for working capital. Low borrowing rates no longer exist as interest rates range from 12% to 100% per annum for SME loans via the alternative finance lenders. Most lenders require director guarantees, additional collateral and debentures on the business. SME invoice finance for most of the business community still remains at a very nascent stage of development. That is why we have launched Clear Factor to change the playing field forever.”

So what does Clear Factor bring that is new to the sector, as the invoice financing industry has been using the banks’ collapse of 2008 as their marketing tool for the last decade?

Clear Factor is a new financial paradigm that has absolutely no reliance on banks which is attractive from a customer point of view. We have seen how people are flocking to digital platforms such as Tide and Starling instead of the high street banks.

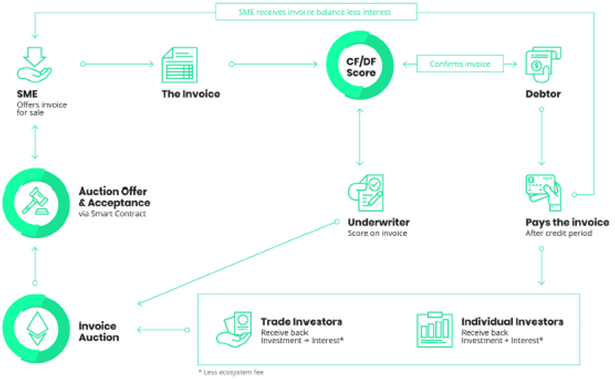

Clear Factor is levelling the playing field so that all SMEs can access all investors on a global level through the auction system. Clear Factor will give every viable SME anywhere on the planet, in any currency, access to the affordable working capital they need to grow. The fair interest rate will be determined by the auction and agreed to by the SME.

Clear Factor is focusing on micro and small segments of the SME market – those that are not currently serviced by banks for invoice finance. There are no lock-ins, impositions, hidden costs or contractual binds and there will always be a quick payment against the invoice. The only fee is the ecosystem fee which is 1.0% of the withdrawal amount taken and this applies to the SME, individual investor and trade investor.

What is not ‘new’ but important for Clear Factor is that the company has a mandate to make sure that it is recession robust. It is about protecting SMEs from a possible future financial crash and a repeat of 2008.