By Gary Fisher, Head: Member Education Services and Individual Consulting at Alexander Forbes

No matter your age or current stage of life, you probably have questions in the back of your mind about retirement, such as “When do I retire?’ ‘What options do I have?’, and ‘Who can assist me?’.

The simple answer is that you decide when you want to retire – there is no specific event or deadline which forces you to retire. The company you work for stipulates your required retirement age but this does not mean that the stipulated date is the starting point of your retirement. If you are lucky enough to continue working past this date either for your current employer or a new one, then what you do with your retirement savings becomes of the utmost importance.

Today, there are different options available to you when your required retirement date becomes a reality and you are asked to make a choice. One of the options is that you simply notify your employer that you have not yet decided to retire from the fund and would like to leave your money in the fund until further notice. Nothing will change and you remain a paid-up member of that fund, receiving regular statements and notifications. The only thing that changes is that you can no longer make contributions into the fund. However, your retirement savings will continue to attract growth based on your selected investment strategy, just like it did before your required retirement age. You will notify your fund when you want to retire and need your money.

Some retirement funds offer additional benefits while you are employed, such as group life insurance cover, personal health insurance, disability cover and funeral benefits. These benefits usually end at your required retirement age. However, should you still require this cover, make enquiries with your employer whether a continuation option exists and what it would cost you to continue with the cover.

Those who are many years away from their required retirement age might be thinking all this talk about retirement doesn’t apply to them yet. Think again, as time flies by quickly. So while you have the opportunity and time on your side take the necessary steps to ensure that when your required retirement date comes around, everything is in place and the planning is done. In this way, you can make a stress-free, seamless decision about your retirement.

Here are some tips which will assist in securing your financial well-being by the time you reach your retirement date:

- Make additional contributions into your retirement fund

Most retirement funds have flexible contribution rates which allow you to choose how much you want to invest each month. The decision you make, however, has far-reaching consequences, as it affects the final amount that you receive at retirement. Choose an affordable amount and review your decision at least once a year. If you are lucky enough to receive a bonus, consider taking a portion and paying it into your retirement fund. To work out what is an affordable amount for you, ensure that you have a budget in place which sets out all your earnings and expenses and how much extra money you have available once all your expenses are taken care of. Reviewing it regularly allows you to keep track of how much extra you can afford and contribute.

- Harness the power of compound interest

Compound interest is when you get to the point of where the interest on your investments, is earning interest. The key to this solution is to start investing as soon as possible and as much as you can afford.

To understand compound interest, we need to first understand simple interest: You deposit R1 000 into your savings account assuming an interest rate of 5% a year. At the end of the first year the amount in your account is now R1 050 (made up of your R1 000 investment and R50 interest earned).

What happens the following year? This is where compound interest starts to work its magic. You will earn interest on your initial R1 000 deposit and interest on the interest you have already earned. In our example the total amount in the account at the end of year number two is now R1 102.50 assuming the interest rate is constant. The secret ingredient here is time: the longer you leave the money invested, the greater the amount becomes and the more you harness the power of compound interest.

- Keep your retirement savings invested when changing jobs

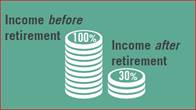

According to the Alexander Forbes Member Watch, the average South African employee retires on a pension income that’s around 30% of their last salary. This is mainly because they take their retirement savings in cash when changing jobs rather than keeping them invested. Withdrawing their retirement savings between jobs interrupts the power of compound growth. You have a number of options available to you to ensure you remain invested for the long term, including leaving your retirement savings in the fund when leaving your employer.

- Partner with a professional financial adviser

Take time to read widely and research financial topics you are grappling with so that you can ask informed questions when you meet with a financial adviser. The role of the adviser should begin from a position of trust and that trust can only be built over a period of time. Find an adviser who can explain financial concepts simply. Make sure they are suitably qualified and carry the Certified Financial Planner designation. In this way, you will receive targeted advice that is unique to your circumstances to assist you in achieving your financial goals both now and in the future.

The decision of when to retire remains yours, but before you get to that point and need to make important decisions, take some time to assess your current situation. Make necessary tweaks to ensure you set yourself up for your best possible retirement.