- Two thirds of people in the UK are still unaware of open banking a year on from its launch across the UK, according to new research from CREALOGIX

- Gen-Zs and Millennials three times as likely to view open banking positively compared to Baby Boomers

- Overall, 68 per cent of people would find open banking features useful

Today, digital banking software provider CREALOGIX released new UK consumer research revealing that, more than a year on from launch of the UK Open Banking initiative, consumer awareness remains low. Two thirds of UK consumers stated that they had never heard of the Open Banking initiative, while 1 in 5 consumers had heard of it but could not confidently explain what it is.

Open banking legislation throughout Europe extends a range of new requirements onto all licenced banks, e-money firms, and payment service providers, and implementation within financial institutions has been under way for over two years. Similar research by CREALOGIX conducted a year ago (February 2018), found that less than 15 per cent of consumers knew what open banking meant. This latest consumer survey demonstrates that little headway has been made when it comes to consumer recognition and understanding of open banking, at least in terms of name recognition.

Perceived risk of bank accounts being “open”

With only a minority of consumers able to say what open banking means, expectations are negative, with less than 8 per cent of survey respondents stating they feel it is a good idea. Common concerns focused on security and privacy risks created or increased by open banking, with a third of consumers believing that malicious attackers may use open banking technology to breach privacy or commit fraud.

UK consumers’ negative view of open banking is not consistent across age groups – Gen-Zs and Millennials are three times more likely to think of open banking as a good idea. However, consumers of all ages express concerns about privacy and fraud in relation to open banking, with even more Gen-Zs and Millennials noting perceived threats than Baby Boomers (72% vs 66%).

Consumers keen on useful features of open banking

While a lack of consumer awareness may paint a negative picture in the short term, the research showed strongly positive views when the words ‘open banking’ were left out of questions, and people were simply asked about what banking features they would find useful.

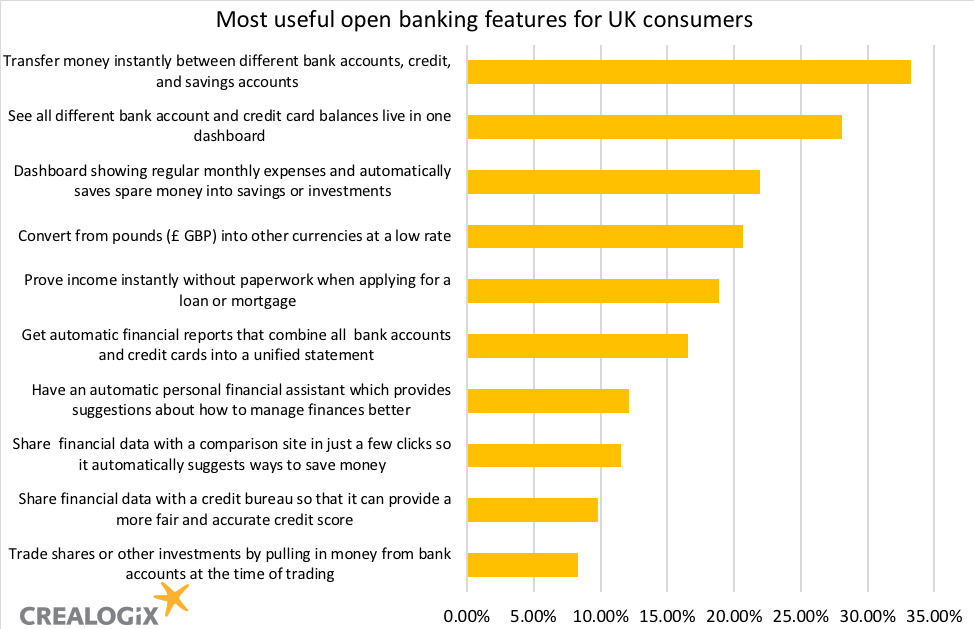

The research showed that more than two thirds of consumers are interested in mobile and digital banking features directly associated with open banking. The most popular features are those associated with aggregation of accounts and convenience in money transfer and management. As these are functions at the heart of open banking legislation and technology, it indicates that the open banking movement is likely to be positive overall for consumers in terms of tangible enhancements rather than in the abstract.

Open banking potentially allows consumers to manage all their financial services brands through any one of them. Open banking features which UK consumers consider most useful-sounding are:

- Instant transfer of money between different bank accounts, credit, and savings accounts (33%)

- See all different bank account and credit card balances live in one dashboard (28%)

- Dashboard showing regular monthly expenses and automatically saves spare money into savings or investments (22%)

- Convert from pounds (£ GBP) into other currencies at a low rate (21%)

- Prove income instantly without paperwork when applying for a loan or mortgage (19%)

Anton Zdziebczok, Head of Product Strategy at CREALOGIX UK, said: “This research highlights what sounds like a contradiction from consumers. While they are unaware of what open banking is and, to some extent, are fearful of it, they are keen to get the convenient and powerful new features that are being enabled. Of course, this is not a contradiction at all: as with any technology, consumers are not particularly interested in what it’s called or how it works: they care about how it can make their lives better.”

Jo Howes, Commercial Director at CREALOGIX, commented: “The priority in open banking is actually not to educate customers better because, frankly, they don’t actually care. As mobile app users, we just want to know when specific new features are available and we will judge innovation purely on the basis of whether it makes our lives easier. However, even though consumers are not interested in details of regulation and technology, industry leaders absolutely do need to care. Financial service providers, including banks and building societies, need to ensure they are on top of the latest industry changes and that they are implementing and providing the features that customers are looking for.”

CREALOGIX provides digital banking software to financial institutions who seek to accelerate their time to market with new customer-oriented features and services.