By Vangelis Tsianaxis, head of risk and compliance consulting at IPC

A critical factor to innovating in capital markets and trading

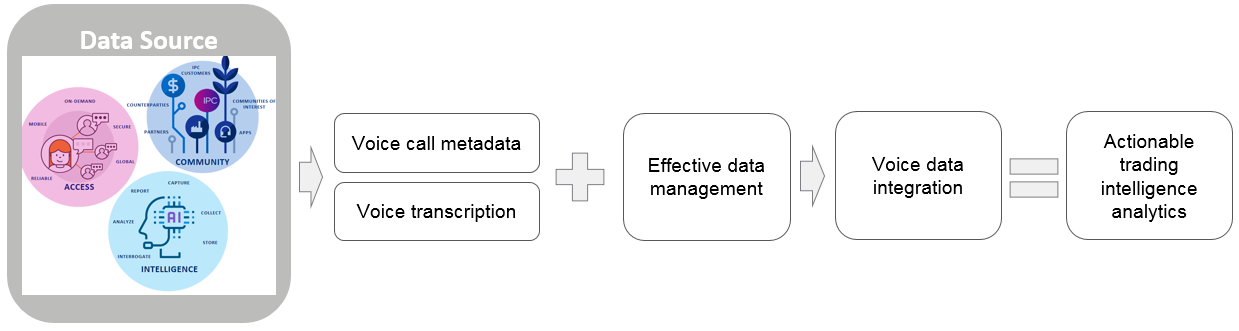

There has been a lot of debate on the value and future of voice trading. Much of it has been generated by the potential effects of MiFID and best execution focus by regulators globally making it is clear voice trading is here to stay. Any market participant able to innovate in the future needs to understand how trading decisions are made in this environment. Voice trading through its generation of data points critical to trade decisions can offer that valuable insight. Voice transcription technology can integrate data into the day-to-day processes of all market participants and enable the generation of fit-for-purpose structured data to utilise across trading lifecycle processes.

With automation and AI capabilities, why voice trade?

In the last few years, market participants have automated processes towards enabling STP (straight through processing) downstream from the trading decision. The key drivers for these technological investments have been to:

- Manage return on equity vs. cost of capital ratio

- Meet regulatory transparency requirements

A lot of focus has been placed on eliminating data breaks that lead to manual intervention, rework, and cost.

This automation produces significant benefits for managing the cost of transacting, certain market activities, such as equities trading, and processes in the lifecycle, mainly past the point of the trade decision. As automation increases across the market and its participants, efficiencies in parts of the end-to-end trade lifecycle that used to be revenue generating are becoming commoditised nevertheless, as the return on further automation of this type is diminishing. Decisions automated through algorithmic trading, however, still depend on the ability to keep feeding relevant intelligence back into the automation loop.

In essence, the challenges for most market participants remain the same, in terms of generating value for their clients by:

- Being savvy in addressing liquidity challenges

- Producing tangible value for clients through best execution like making good, cost-effective investment decisions

- Being transparent about the ability to generate this type of value to their clients and to regulators.

Delivering on all these requirements is dependent on keeping the pulse of the market, talking to the other participants and having advanced capabilities to manage the communications intelligence generated by these interactions. That type of capability can be achieved by integrating such intelligence alongside other data points related to the client and the market and making them easily and readily available to client-facing functions.

Indeed, the opportunity for significant innovation and differentiation in the market lies in the efficiency and effectiveness of your front office’s client relationship management and interactions. The integration of voice-generated data is still a large, untapped opportunity. Traditionally, it has been seen as a technical challenge due to the perceived complexity of managing the data.

As such, the ability to fully realise the value of automation depends on controlling the quality of data generated at the point of making the investment decision and initiating an order, the decision point during a telephone conversation. Even existing automation downstream to the trade decision needs better data from the voice trading environment. Voice trading is critical to realising these competitive advantages.

Competitive advantage and asset managers

Utilising such intelligence about clients is particularly important to asset managers as their business models are changing with many turning to outsourcing, offshoring, smart sourcing, and digitalisation of their support functions. Essentially, the asset manager business model is shifting towards reducing non-core activities, i.e., those that do not impact their client interactions directly.

These players depend on maintaining and enhancing high touch, voice communication-driven activities within the firm, to ensure they:

- Differentiate themselves in the market, through personalised services and confidence in the decisions they make, particularly on behalf of their most valuable clients

- Maintain higher margins by offering more innovative, higher value deals to clients

- Create new opportunities by innovating the way they provide services and address investment needs.

As the model of managing the middle and back office changes, generating good input data becomes critical to ensuring you can focus on the core business of managing clients. It is also critical to have good post-execution data to have the right intelligence and to enable the next great interaction with the client with the support of these partners.

Automation improvements and deals where a lot of the interactions and decision making happens on a phone call

The opportunities that exist when turning voice into structured data can allow businesses to:

- Reduce the cost of highly valued individuals (traders, portfolio managers, brokers) working on mundane tasks such as data input for an order and responding to inquiries about data completeness from other functions such as risk and compliance.

- Integrate the intelligence generated by the execution of orders fast and reliably to enable better decisions on best execution, particularly in fast moving markets such as FX trading.

- Capture accurately and timely trade events generated through voice communications to support effective TCA (transaction cost analysis) for transactions.

- Manage the data completeness and speed of capturing a decision to trade within an order system, allowing effective enrichment of the data to support execution and post-trade activities and reporting.

- Enable risk and compliance decisions based on more readily available data and automation on the trade decision made over the phone, including surveillance and ongoing reporting to the market and regulators.

Indeed, businesses should tap into the unused intelligence offered by the voice conversations of key employees when they are making decisions to trade. Using the conversations to tap into the critical data points referred to in these conversations can generate intelligence that creates an edge in ongoing trade decisions. This data can be generated by voice transcription technology that is specifically targeted to trading environments to ensure a greater effectiveness of the data capture.