By Mark Shields, Director of Solution Marketing at Appway (an FNZ Company)

Digital tools to help wealth managers adapt their offers to customers’ evolving needs while meeting compliance demands

Recent ThoughtLab research, Wealth and Asset Management 4.0: How Digital, Social, and Regulatory Shifts Will Transform the Industry, highlights new trends in the way both very-high-net-worth and mass affluent investors approach investments.

A new wave of digitalization has spiked the interest in complex financial products, especially among mass affluent investors. Research reveals that this historically overlooked group no longer relies exclusively on exchange-traded funds and mutual funds for its investments and is instead starting to branch out and opt for alternatives, structured products, even art and other non-bankable assets, that had traditionally been the domain of high-net-worth and very-high-net-worth investors.

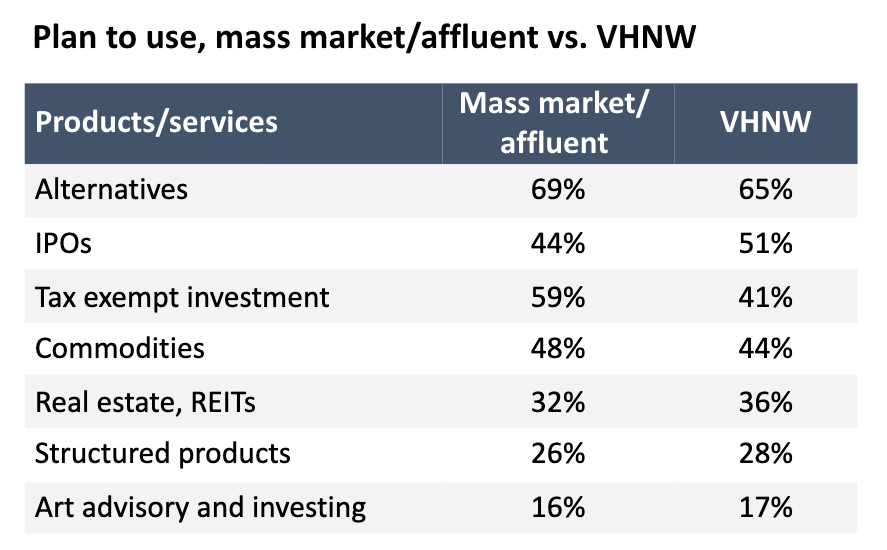

ThoughtLab research compared investor preferences, across all wealth levels, revealing there is little difference between very-high-net-worth (VHNW) investors and the mass affluent in their demand for increasingly complex investment products. In fact, the study shows there is almost no significant difference between the mass affluent’s and VHNW investors’ demand for alternatives (69%), structured products (26%), or art investing (16%).

Actively managed funds are currently being used by around 75% of investors, but this percentage is expected to drop slightly in the next two years, while the interest in passive funds and individual securities will continue to grow as investors seek out better returns and look at diversifying their portfolio with alternatives such as hedge funds and private equity.

Long-term tax-sheltered investment products and pensions are also growing in popularity, while cryptocurrencies maintain only a minor share of the market due to concerns about their volatility, but also to regulatory and cyber security risks. Interestingly, specialized products like IPOs, tax exempt investment, commodities and derivatives, REITs, and structured products are being considered at all wealth levels to boost alpha.

However, the evolving regulatory landscape means that to be able to offer elaborate products to the risk-protected, mass affluent market, wealth management firms need to make sure that documentation and processes are especially well managed, accurate and auditable. To do this, all relevant regulatory KYC profiles and risk appropriateness documents and client confirmations must be filled and filed correctly right from the start, during the onboarding stage, and then periodically reviewed. The result is a considerable burden on wealth managers.

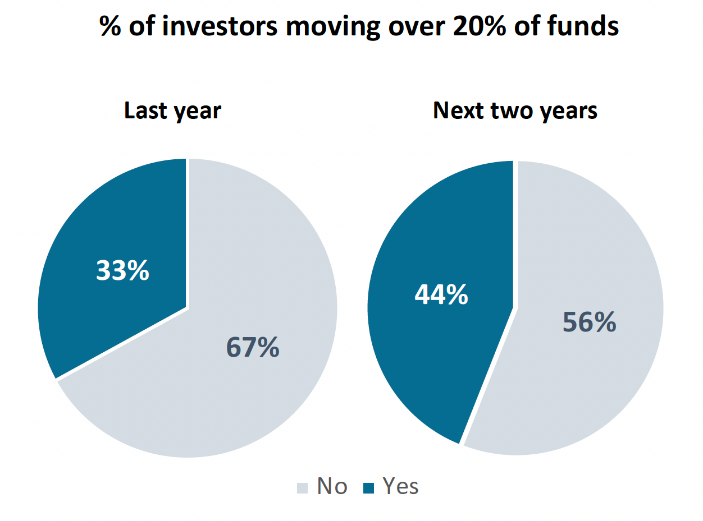

ThoughtLab research also found that investors are looking to diversify not only investment products and services, but also wealth management providers: 33% of investors switched wealth managers in the last year, while almost 45% of investors are planning to add to their wealth management relationships in the next two years. This significant exchange of capital flows will fire up the competition between wealth management firms. Invariably they will need to consider the key role that a seamless digital onboarding and service activation experience can have on acquiring – and then keeping – both new and existing clients.

Indeed, one of the main reasons cited by investors for transferring assets is the need for a stronger digital experience, along with better investment performance and wealth advice, access to greater personal service and clearer pricing structures and fees. This sends a clear message to wealth managers: focus on core investor investment needs but ensure service is digital.

The wealth management sector is becoming more competitive and complicated, especially considering the disaggregated systems and service processes, the hybrid work environment and evolving investor expectations. It appears clear that systems and processes need to be optimized and automated at the earliest stages of investor contact to help lay solid foundations for later customer relationship development and growth. In particular, the first-impressions, onboarding stage is far too important and complex to be managed manually or with paper-based-tools.

It is therefore critical for advisors to have access to the right tools to manage increasingly complex processes, making sure new customer relationships start on the right foot. The ThoughtLab industry outlook highlights the importance for advisors to connect people, data and systems to guarantee a smooth client experience, while maximizing efficiencies for both the front and back office, without risking compliance. Even the smallest inconvenience during this delicate process can result in loss of business or lengthy and costly remediation.

Wealth managers should opt for a seamless, digital onboarding experience to help them grasp the opportunity coming their way in the next two years within the mass affluent market. A digital onboarding experience can also play a key role in streamlining processes, making them faster and more compliant. It allows more precise data collection, thus delivering a simple, intuitive, and positive first impression and helping to improve efficiency in an increasingly complex and diverse mass-affluent market.