By Mark Shields, Director of Solution Marketing at Appway

As the years go by, the market changes, and so do your clients’ needs. It is thus fundamental to keep up with emerging demands, especially in a sector like wealth management. Data shows that not only one in three investors (30%) but also 55% of billionaires switched wealth management providers or transferred significant funds to other wealth managers over the last year. But this is just the beginning: the trend is set to continue with 44% of investors declaring that they intend to switch in the next two years in recent ThoughtLab research, Wealth and asset management 4.0- How digital, social, and regulatory shifts will transform the industry. If you’re wondering what the driver behind all these changes is, part of the answer is undoubtedly a demand for greater digitalization.

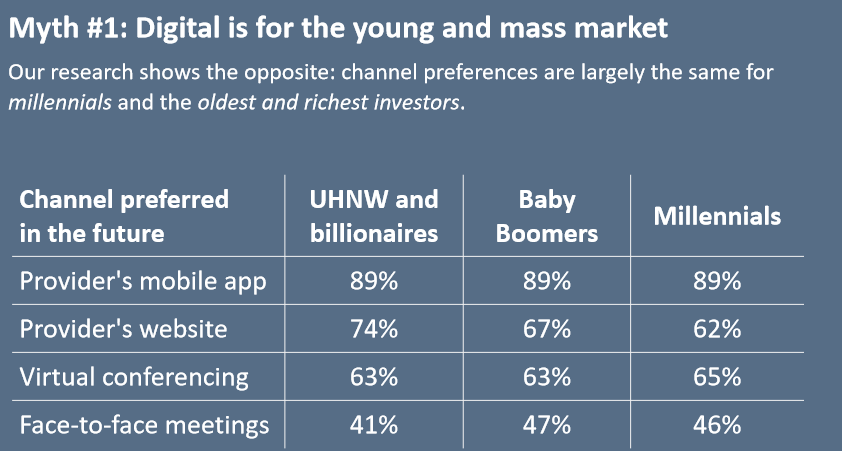

When faced with a lack of digital options, the risk of customers switching becomes very real. The ThoughtLab survey analyzed four groups of investors: the Ultra-and-High-Net-Worth individuals, Millennials, and Baby Boomers. Their responses on digital were remarkably consistent, with 89% of investors from every group choosing mobile apps as their preferred communication channel for the future. Websites also remained popular and were selected by 74% of High-Net-Worth individuals, followed closely by 67% of Baby Boomers and 62% of Millennials.

UHNWs demand a quicker and more practical process

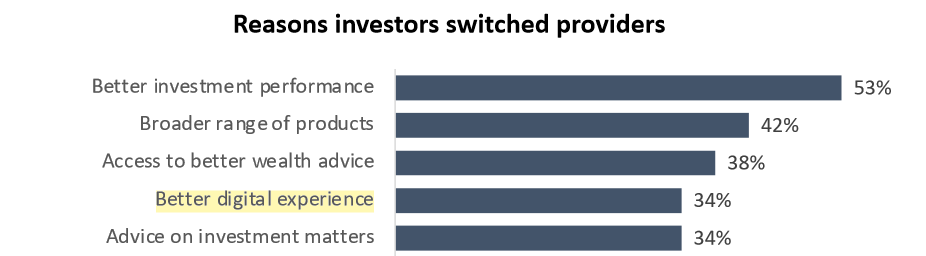

Indeed, in addition to changing providers to pursue better overall investment performance (53%) and access a broader range of products (42%), a lack of digital presence was, in fact, quoted by over a third (34%) of respondents as a driver to switch provider. This finding clearly highlights how vital digital access to services and tools has become.

Other reasons for switching include access to better wealth advice (38%), advice on investment matters (34%), better personal service (31%), access to holistic financial planning (28%), having a personal contact or advisor whom they trust (24%), a fee structure that better meets their needs (23%), lower fees (19%), a desire to manage their assets directly (19%), access to social impact investments (16%) and a culture more aligned with their values (13%).

The assumption that older, wealthier customers only want face-to-face interactions has been debunked and requires immediate action. Indeed, even though over 40% of respondents say they would prefer in-person interactions in the future, a large majority is changing the way they imagine their relationship with wealth management. Specifically, while in-person meetings were dominant prior to the Covid-19, 47% of Baby Boomers now report that they would prefer to get in touch with their wealth advisor via the webcam in the future. 46% of Millennials and, perhaps surprisingly, 41% of UHNWs agree. The familiarity we have all acquired with video conferencing and digital tools over the different pandemic lockdown phases have smoothed concerns about digital interactions and highlighted the benefits of remote meetings, which can help time-poor individuals squeeze more into their day.

Channel preference by investor segment analyzed

These results depict an industry that is undergoing a radical change in customer mindset, one where the balance between touchpoints is dramatically changing. Wealth managers and advisors would do well to sit up and note these striking results as soon as possible.

A more modern customer experience, such as the one investors from all demographics and income brackets are calling for today, depends on providing a better overall digital experience. As first impressions count, it seems natural that it should start with a seamless digital onboarding process.

Digital onboarding that is simple, intuitive, and efficient eliminates friction and unnecessary touchpoints with clients by creating a tangible service differentiation and fostering customer loyalty. Making it possible to serve clients however they want from wherever they are also speeds up onboarding times while increasing an advisor’s ability to provide more tailored and high-value experiences. Offering the proper range of effectively managed touchpoints helps assure the investor they have selected an advisor that understands their needs and values their preferences and time concerns driving customer loyalty.