James Burton, senior director of insurance product management for U.K. and Ireland, LexisNexis Risk Solutions

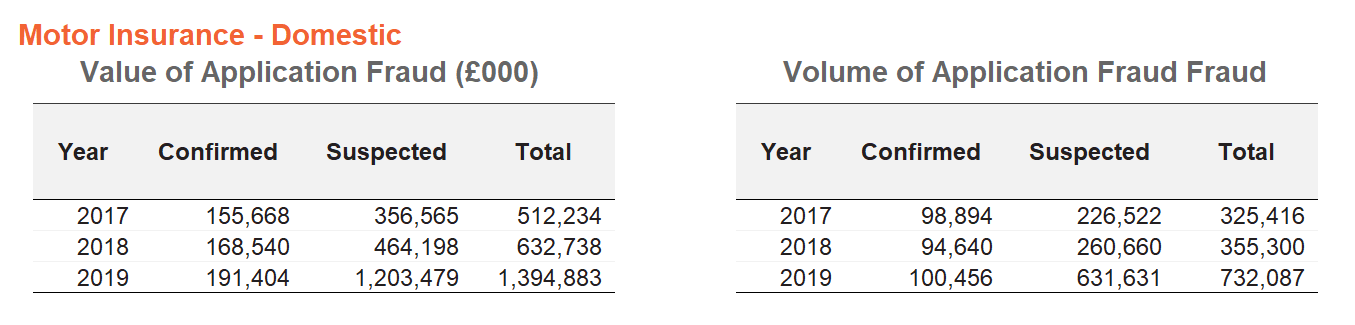

The days when insurance fraud related almost entirely to exaggerated or false insurance claims are long gone. Application fraud is now a major challenge for the insurance market. Figures from the Association of British Insurers (ABI) show that in 2019, cases of insurance application fraud rose by more than 200% on the previous year, which equates to 760,000 cases of detected insurance application fraud, worth £1.45billion[i]. The vast majority of reported cases of application fraud relate to private motor insurance, which in 2019 amounted to £1.39billion[ii].

Application fraud is often the deliberate misstating of data (such as previous claims) in the application to get a cheaper quote. However, it also includes the more pernicious use of stolen or fake identities to buy insurance to sell on to unsuspecting motorists.

The individuals perpetrating these frauds are known as ‘ghost brokers’. Their common strategy is to promote unrealistically cheap car insurance on social media. They will then sell on fake policies using stolen identities to unwitting younger or high-risk drivers, perhaps with prior motoring convictions, who are in search of a cheap motor insurance policy.

The growth in identity fraud related crimes has been highlighted during the pandemic.[iii] Aviva, one of the world’s largest insurers, recently confirmed that the number of cases of application fraud and ghost broking they had detected had grown over a third in 2020[iv]. And earlier this year, The City of London Police’s Insurance Fraud Enforcement Department (IFED) confirmed that from January to December 2020, Action Fraud – the national fraud and cybercrime centre – received 694 reports of ‘ghost broking’, with almost a third (29%) coming from victims aged 17-29. The reported losses for these victims alone totalled £113,500, nearly three times the amount lost by 30–39-year-olds, with each individual losing an average of £559[v].

In response to this rising threat, the insurance market has developed strategies to tackle ‘front end’ fraud using identity (ID) validation checks to help confirm the applicant is who they say they are. Crucially, these checks need to be conducted at speed, at point of quote and without unnecessary friction. As such, ID validation checks have become part and parcel of a swift risk assessment process. This process leverages data enrichment and high-volume capability platforms that provide a single point of entry to a whole host of private and public risk data for the insurance market, including industry databases of known fraudsters such as the National SIRA database[vi].

Access to National SIRA is a vital step in the ID validation and fraud prevention process. It works by matching the insurance providers’ customer data against the database to flag potential fraudsters, prior to or post policy inception.

Key to the success of this approach is the ability to match the two sets of data – especially where there may have been deliberate errors and misspellings included in the information provided to the insurance provider during the application. The more data points that can be matched – the greater the match rate. This has led to the inclusion of email address and telephone numbers in our Point of Quote API call to National SIRA, to deliver improved match rates – helping insurance providers to identify fraudsters before they become customers.

Along with enhancements to our service with National SIRA, email address intelligence can strengthen the ID validation process even further, helping the insurance market spot potential cases of application fraud early in the customer on-boarding process. It’s an approach that is already working to tackle identity fraud in the banking sector and now the benefits are being extended to the insurance sector.

An email address is a unique global identifier. 91%[vii] of people have had the same email address for three years or more and 51% for more than 10 years. In addition to being a persistent identifier that stays with a person over time, it is also linked to multiple online accounts and transactions. This means each individual email address creates a digital footprint which could make it one of the most powerful tools for detecting application fraud.

Based on billions of transactions from global payment processors and other online industries, including 82,200 fraud events shared on average daily[viii], insurance providers can now access an instant risk score[ix] as part of the risk assessment process. This score indicates whether the identity is genuine or whether it could be fraudulent – based on an individual’s email address information and other personal information provided, at the point of quote.

Risk is assessed by evaluating email address metadata points, such as whether the email and domain even exist, or whether the email bears a close resemblance to the proposer’s name for the policy.

As well as automatically validating every quote that comes through, the email address risk score can also bring a new layer of insight that helps inform pricing decisions.

The global pandemic has dramatically expedited the insurance industry’s adoption of digital business. This has only heightened the need for robust ID validation checks at the point of application, quote and post policy inception while at the same time providing a seamless online experience. The enhanced matching capabilities of National SIRA hosted by Synectics Solutions Limited and email address intelligence through LexisNexis® Emailage® Rapid are taking ID validation to the next level. These innovations are set to boost the insurance market’s resilience to identity fraud, without compromising the experience of the genuine end customer.