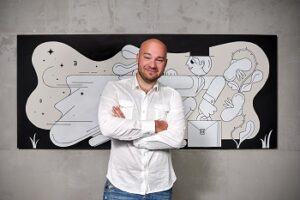

Mercuryo’s CEO and Co-Founder Petr Kozyokov.

With businesses looking to offset the impact of the last two years, it’s little surprise they are looking to new technologies to cut costs, streamline processes and tap into unmet customer needs in order to improve their bottom line. At Mercuryo, a global payments network, we’ve recently undertaken key research into the current mindset of businesses and looked at how businesses view new payment innovation and the rising role of cryptocurrencies.

We found that a third (34%) of UK finance businesses now make payments via the blockchain, a significant proportion. This demand is reflected in the recent news that Visa is launching its own crypto consulting service to help clients navigate the world of cryptocurrencies. With Fintechs clambering to harness crypto technology, key market players such as Revolut are already looking at building their own crypto exchange to broaden their offering, signifying a potential new era for the mass adoption of digital currencies within the financial services landscape.

According to the FSB, SMEs account for three fifths of employment in the UK and as much as half the overall turnover in the UK private sector. So it’s clear they are a key driving force for the UK economy, but failing to keep up with innovation means they risk falling beyond the competition.

Looking to make significant savings and reduce lengthy payment times, 68% of all businesses agree that there is a need for greater innovation in payments and that is echoed by their customers as three in five (58%) businesses report increased demand from customers and partners for cryptocurrency as a payment option. This figure when split out rose to 75% among large businesses and 43% among SMEs.This is in line with the demand we’re seeing at Mercuryo from customers looking for providers who can offer them both fiat and crypto services, enabling them to easily pay via whichever payment type they choose.

When asked about the advantages of using cryptocurrency compared to traditional B2B payment methods, 24% stated innovation, confidentiality and security were both reported by 23% of businesses and faster transactions was the key benefit for 22% of respondents.

With ever-increasing interest from customers, it’s no surprise that 55% of businesses now view cryptocurrency as the future of payments, with 57% of all businesses claiming they believe accepting cryptocurrency payments will give them a competitive edge.

In fact, findings show that a further fifth (20%) of all businesses are considering adoption of crypto payments within the next three years. And that aligns with our thoughts as we predict that in just a short few years, crypto and fiat payments will reach an equilibrium.

Download the full report here-https://blog.mercuryo.io/post/uk-b2b-report