Banking customers are increasingly opening multiple accounts, particularly the younger generations, with up to a third of Millennials and Gen-Zs having opened at least two new accounts in the past 5 years. The research, commissioned by digital banking software provider CREALOGIX, found consumers are attracted by mobile features that improve convenience, functionality and control.

Gen-Zs (survey respondents aged 18-21) are particularly active in opening new accounts; 81 per cent would consider opening an additional bank account in the next three years, dropping slightly to 75 per cent of Millennials. These younger generations are driving the rapid adoption of challenger banks, with a quarter of those under 37s surveyed already using mobile-only challenger bank accounts. The research found that Monzo was the most popular with Millennials.

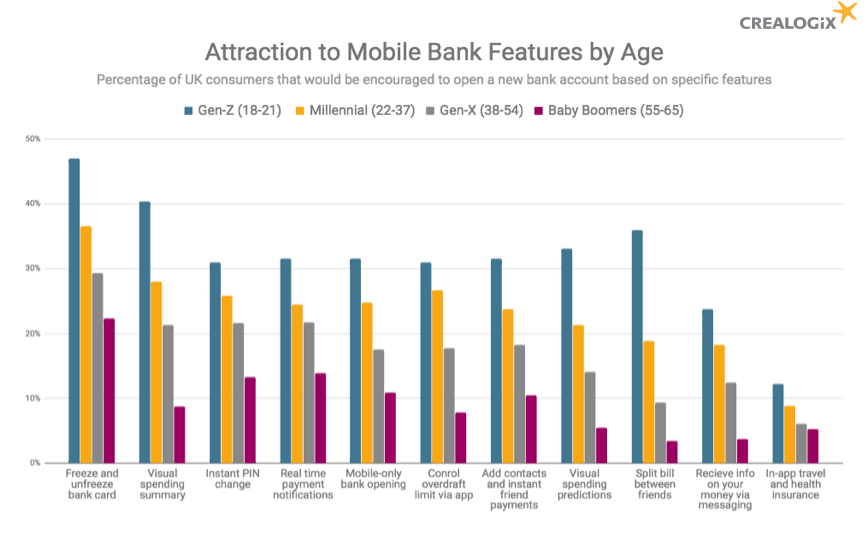

Mobile banking features attract new account signups

When asked what they look for when opening a new account, respondents overwhelmingly responded with feedback relating to mobile banking user experience, including convenience, functionality and easy control over their account. Under 37s are particularly inclined towards mobile banking features, with 83 per cent of Gen-Zs and 76 per cent of Millennials stating that access to certain desirable features would attract them to try out another bank. Gen-Zs will soon make up the largest demographic cohort, so user experience innovations pioneered by challenger banks are set to provide them a strong advantage in continuing to win market share unless high street banks are able to offer more feature parity.

A graph showing the percentage of UK consumers that would be encouraged to open a new bank account based on specific features

Anton Zdziebczok, Head of Product Strategy at CREALOGIX UK, said: “With the recent anniversary of the Open Banking initiative, our research found that the directive has had a positive impact on overall competition in the retail banking market, and customers are increasingly trying out new bank accounts. This comes as good news for financial regulators, who have been fighting in the 10 years since the financial crisis for more consumer choice and innovation in the highly concentrated UK retail banking market.

“This increased competition encourages innovation, ultimately delivering the best experience to the consumer. However, where the agile, mobile-first banks are using technology to win new customers, the incumbent banks have been slower to adapt.”

Jo Howes, Commercial Director at CREALOGIX UK, commented: “To compete and stay relevant, every financial institution needs to increase the pace of innovation and offer differentiated mobile user experience features to satisfy digitally-demanding customers.

“For now, the challenge for established financial brands is simply how to maintain reasonable feature parity with the challengers, and time is of the essence. With every passing month, the feature and design gap between challengers and less technologically agile banks is widening. Butestablished banks have the foundations of trust and market share to keep them ahead of the game. They are more than able to bring the competitive fight back to the challengers if they succeed in using technology to place their customers at the heart of their business.”

CREALOGIX provides digital banking software solutions to financial institutions who seek to accelerate their time to market with new customer-oriented features and services.