Thomas Rex, SVP at Fingerprints

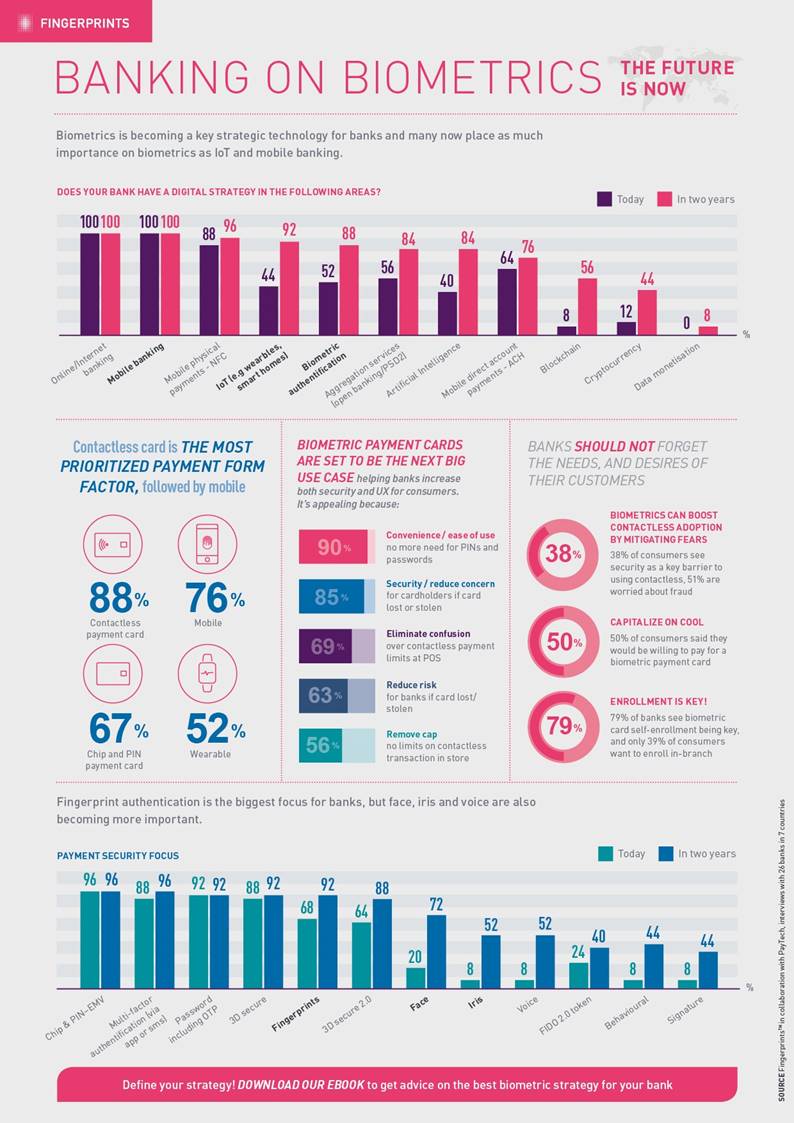

Innovation comes in many forms. It makes the world around us look better, work faster and be more useful for companies, consumers and communities. Biometric technology has been around now for some time, but recent technological developments are driving significant adoption across new use cases, especially in banking & payments.

We spoke with banks and consumers across the world, and we have identified a wealth of opportunities for banks that are embracing biometrics. From turning up the style to increasing revenue, here are some of the ways banks look set to benefit.

Ease and style

75% of bank respondents see fingerprint biometrics as the most user-friendly and slickest security method, whilst offering the best UX. As shown by the high rate of adoption in the smartphone market, consumers rate this method as well. Not having to remember or use a PIN code is a key benefit, especially for the older segments that are at risk of being left behind in an increasingly digital and cashless world.

What’s more, banks and fintechs are bringing out innovative new card designs. From vertical orientation to gold inlays and metal cards; biometrics are the perfect accompaniment to ramp up the style as its coolness factor is a key driver for consumer adoption beyond the ease of use and security.

A premium offering

When it comes to roll-out, 56% of our surveyed banks plan to introduce biometric payment cards as a paid service for premium customers. This offers the opportunity to increase revenue from payments, as well as adding a point of differentiation against competitors.

Increasing the value of transactions

As the motivation behind the trials like NatWest’s in the UK and Société Générale in France shows, being able to remove the cap on contactless payments is a big selling point. 79% of banks we spoke to cited payment caps as the main limitation of contactless cards today. Biometric payment cards offer a secure solution to ‘scrap the cap’ and realize the true potential of contactless. The feedback from ongoing pilots also shows an increased transaction value when using biometric cards.

Getting one step ahead of competitors

100% of the banks we spoke to are aware of biometric payment cards, however only 24% consider themselves fully informed. For those banks willing to invest in research and prioritize biometrics in their innovation roadmap, the opportunity to overtake competitors is there.

Addressing customer security concerns

Contactless security is one area where banks and consumers disagree. Despite only 57% of banks considering security to be the main issue around contactless, this is consumers’ primary concern. Biometric-authenticated payments across mobile and card are an effective solution to help build consumer confidence. Recent research by Gemalto, a Thales company, showed that 86% of respondents believe biometric payment cards are more secure than traditional Chip and PIN.

Unifying the journey

Another benefit of introducing biometrics is to bring harmony to the UX across mobile, online and in-store. As the focus on the customer journey has shown over the past few years, delivering clunky and frustrating shopping journeys is a sure-fire way to lose customers and revenues. This is seen by respondents as particularly important for addressing the younger and more tech-savvy consumer segments, seeing the latest cool innovative biometric card as a great companion to mobile wallets and other payment devices.

An opportunity needs to be acted on

It’s clear that biometrics offer a lot of potential when it comes to the innovation roadmap for banks. Increased revenue avenues; alleviating consumer concerns around contactless security; improved UX…these are all achievable in the short to mid-term.

What happens next is in banks’ hands.