By Jaco Prinsloo, certified financial planner at Alexforbes

Financial planning regarding the succession of investments is rarely carried out, at least in South Africa. As a result, potential heirs are often not sure what to do or where to start to claim and settle a loved ones investments. In many cases, the family is unaware of the existence of an investment portfolio. With succession planning, the transfer of assets (whether property, your bank accounts, cars or investments) is facilitated.

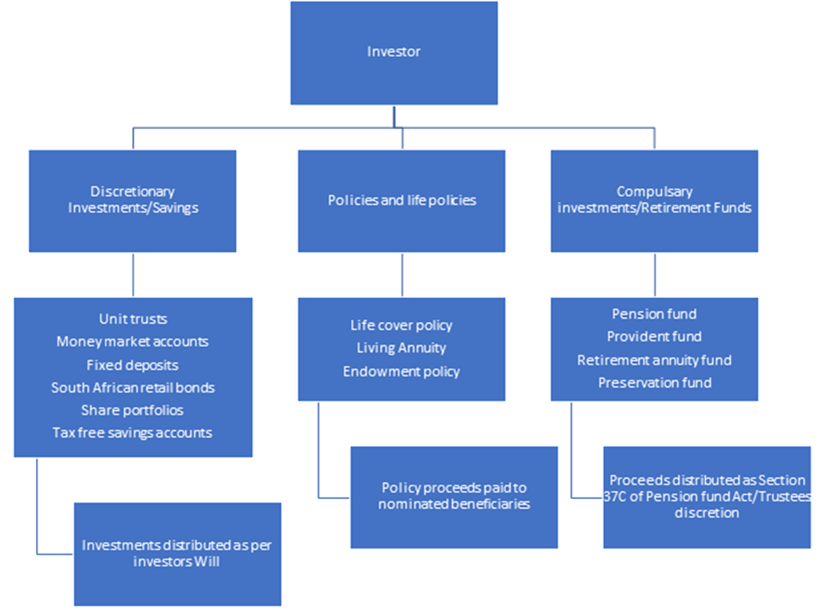

Today I want to focus on investment and the succession planning of investments, specifically discretionary investments, compulsory investments and policies. The type of investment will determine how the assets and proceeds get distributed, so we first need to look at the different investment types:

Discretionary investments

Discretionary investments are any investment you make with after tax money at your own discretion. Discretionary investments include:

- Unit trusts

- Money market accounts

- Fixed deposits

- South African retail bonds

- Share portfolios

- Tax free savings accounts

These investments will form part of your estate and will be subject to estate duty and executor’s fees. However allthou a tax-free savings account forms part of your estate there are no executor’s fees payable. The proceeds from the investments will be distributed as per your Will to your nominated beneficiaries after your estate has been settled. Because these investments form part of your estate the investments will be “frozen” and no transaction or changes can be made to the investments until the proceeds are paid to the estate.

Investment and Life Policies

Life insurance is a type of insurance contract where you agree to pay premiums to keep your life cover active. If you pass away, the life insurance company will pay the life cover benefit directly to your nominated beneficiaries, which can be a person or your estate.

You also get investment policies like living annuities and endowment policies where the investment value pays to the nominated beneficiaries on your passing. One benefit of investment and life policies is that it does not form part of your estate, which means no estate duty and the proceeds get paid directly to your nominated beneficiaries giving them access to cash while they wait for the estate to be wind up. Making it an essential part of anyone’s overall financial plan.

Compulsory investments

Compulsory investments are investments which are compulsory with some employers. Working for some companies you might be required to be part of a provident or pension fund as part of your employment contract. Compulsory investments might also offer some tax benefits but investors have limited access to their money and these investments are governed by Regulation 28 stipulating where and how you can invest. Compulsory investments can be summarised as “retirement funds” and include:

- Pension fund

- Provident fund

- Retirement annuity fund

- Preservation funds

The proceeds from retirement funds are distributed as per Section 37C of the Pension Fund Act.

Which means the trustees of the fund will use their discretion to distribute the proceeds of your retirement savings to insure all dependents and beneficiaries receive equal and fair benefits. Belonging to a retirement fund you will be required to nominate beneficiaries but its important to remember the beneficiary nomination is seen as a guide to the trustees or a “wish list” and the ultimate decision on how the benefits get distributed lies with the trustees of the fund.

As shown above, it is important to keep your Will and nominated beneficiaries updated on your policies and retirement funds. So how to plan for succession?

The first step is to talk to your family members about your investments and the administrator of these investments. Secondly you can create an organised folder with all the documentation of your investments, policies, copy of your Will and personal documents like your ID copy and bank statements. Your family does not need to know the value of the investments but the knowledge of the investments and where to find all your important documents will make it easier for them to start the claim process. Speak to a certified financial planner for advice on your beneficiary nominations and to formalise your wishes in a document, thus setting up a will.