By Manish Sood, Founder and CEO of Reltio

Financial services organizations are racing to implement the latest artificial intelligence (AI) tools to keep pace with changing customer expectations and tightening industry regulations. The rush to implement these game-changing technologies has exposed a glaring, persistent problem that AI cannot fix-–fragmented, poor-quality data. The proliferation of poor-quality data exacerbates difficulties for financial institutions deploying AI systems, which rely on precise and reliable information to function correctly. As inaccurate data accumulates daily, it poses mounting obstacles to successful AI adoption.

Fragmented data jeopardizes the digital transformation efforts financial institutions require to remain competitive in today’s digital-centric landscape. To fuel technologies like AI and better serve customers, companies need reliable, up-to-date data that flows seamlessly across all systems – a state known as data interoperability. Achieving truly unified, interoperable data platforms will allow institutions to realize the promise of data-driven innovations.

Out with the Old

Despite the urgency of digital transformation, most established financial services firms lack the modern tools and know-how to implement it fully. It can also cost institutions more, as data problems create regulatory challenges. Check recent penalties dealt to slow adopters across the finance sector. In just over a year, from September 2018 to December 2019, regulators fined global financial services companies a whopping $10 billion collectively for noncompliance, according to analysis from Salesforce.

Trouble comes from several corners:

Antiquated systems and siloed operations frustrate the integration of new technologies. The scarcity of in-house technical skills also hampers progress. Research by consultancy McKinsey shows only 30% of financial institutions have successfully completed a digital makeover.

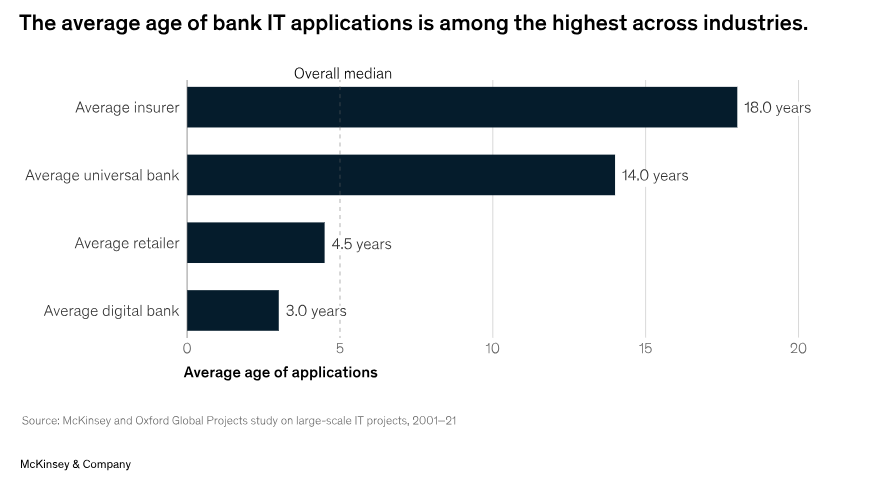

Why so low? These complex overhauls prove deceptively tricky for many banks. Legacy systems still power many critical banking functions, limiting scalability and agility. The average age of a bank’s IT applications, for example, is 14 years old. Outdated architecture struggles to support omnichannel customer experiences or complex regulatory reporting.

Many core challenges persist across the industry:

- A vast portfolio of legacy applications limits the shift to modern deployment models.

- Original designs falter under the scalability demands of a digital front-end.

- The current systems, burdened with archaic codes like COBOL, are cost-intensive.

- While modernizing the external facets is somewhat feasible, the aging core architecture remains a bottleneck.

Data Deficiencies Abound

Quality data should drive any AI strategy, but financial institutions, like many large, established enterprises across most industries, have trouble harnessing their information. Critical customer data often resides in disparate systems and often contains errors.

With the sheer volumes of data financial institutions hold, it is no wonder most are lagging in their data unification efforts. A FI Works study notes that as much as a quarter of the data in the average financial institution’s customer information file/customer information is incorrect. All this points to the fact that they are not ready for AI. Research from Fi Works indicates the average financial company accumulates a staggering 500 million data points for every $1 billion in assets. Still, critical customer and transactional records lie fractured across legacy systems and siloed databases.

This sector also shoulders stringent data regulations around security, privacy, and governance – locally and globally. Lapses leave sensitive customer data vulnerable to cybercriminals.

Rather than rip and replace complex legacy environments, financial institutions should first focus on making existing data usable through unification initiatives. A unified modern data layer will empower institutions to meet customer expectations, adopt innovative technologies, ensure compliance, and gain a competitive edge. Sturdy data unification forms the bedrock enabling business responsiveness and digital success.

Modern Data Unification Tools are Changing the Game

Modern, cloud-based data unification and management tools such as entity resolution, Master Data Management (MDM), and innovative data products like pre-built Customer 360 are at the forefront of the battle against data fragmentation. These tools are not only simplifying the integration and harmonization of disparate data sources, but they are also accelerating the time to value for data initiatives, with some enterprises experiencing tangible benefits in as little as 90 days.

Adopting these cutting-edge technologies enables institutions to unlock new revenue potential by providing a more comprehensive and nuanced understanding of their customers. Enhanced automation and improved efficiencies are further benefits, as streamlined data processes reduce manual intervention and the scope for error. These technologies are also pivotal in enhancing fraud detection capabilities, safeguarding enterprise assets, and reinforcing customer trust.

While the journey toward becoming a data-driven enterprise is fraught with data fragmentation and siloed information challenges, modern cloud-based data unification and management solutions provide a clear pathway to overcoming these obstacles. Enterprises that embrace these technologies are optimizing their data assets and positioning themselves to reap the benefits of improved decision-making, operational efficiency, and competitive advantage in an increasingly data-centric world.

The Path Forward: Clean-Connected Data

Rather than overhauling complex legacy IT environments, financial institutions should focus on making quality data available to feed their modern systems, including AI. With clean and unified data as a foundation, financial services organizations can unlock the true potential of technologies like AI/ML while avoiding the “garbage in, garbage out” trap. Trusted data is the critical building block of digital transformation.