Nick Maynard is a Lead Analyst at Juniper Research

Open Banking has made significant progress in 2020, having recently launched across much of Europe and now starting to emerge in other markets too. And there are two primary reasons why Open Banking is disrupting the banking industry so much:

- Banks have begun to discover the real competitive advantage of a more open approach to banking. Offering a superior Open Banking experience to customers can be a compelling differentiator from other competitors as part of a wider digital app experience. Open Banking also creates a level playing field in markets where regulatory intervention has led to Open Banking deployment. As all banks are required to deploy APIs in this scenario, the situation is the same and does not put any one particular bank at a disadvantage.

- Legislation – for example, in October 2015, the European Parliament adopted PSD2 (the revised Payment Services Directive). By early 2020, major banks in the EU had adopted Open APIs. There have however been many cases of late deployments of APIs and problems with the availability of APIs.

The Disruption Factor

Open Banking is a major disruptive factor for banks. The reason for this being that it opens up account data to both AISPs (Account Information Service Providers) and PISPs (Payment Initiation Service Providers), which can attempt to carve out a role in the banking area.

- AISPs: These new vendors are able to access transaction data and balance information, as well as related information. This has, in particular, led to the rise of vendors such as Emma, Yolt and Connected Money. These vendors combine information from multiple sources, adding value to the user.

- PISPs: In this case, the vendors are able to leverage Open Banking API connections to initiate payments directly from the bank accounts in question. This means that these players are able to bypass traditional payment methods, such as cards. Vendors such as American Express and PayPal have already launched solutions that have taken full advantage of this action.

PSD2 Changes

Generally, the implementation of the new PSD2 European regulation for electronic payment services effectively reduces the entry barriers for new digital players. It also opens up banks to the potential for competition, enabled by their own APIs. This allows these players to compete with existing services in fields currently offered by the banks. In the case of AISPs, it is possible that third-party applications could displace the role of the apps from incumbent players, which would dilute the bank’s relationship with their users.

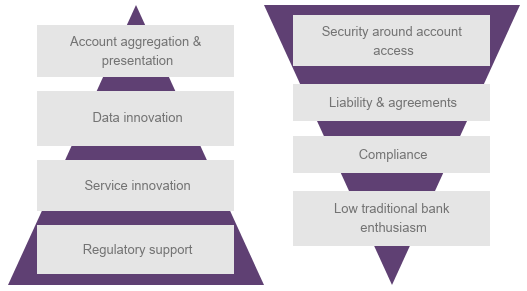

As with any fundamental change to markets in the banking area, there is the potential to bring a number of both opportunities and challenges to consider with Open Banking.

Open Banking Opportunities & Challenges to Consider

Source: Juniper Research

Banks and other parties that are looking to become involved in the Open Banking ecosystem must weigh these opportunities and challenges carefully. Open Banking certainly needs a more collaborative approach than traditional banking models, which will require significant effort to make them successful.

The Forecast for Open Banking

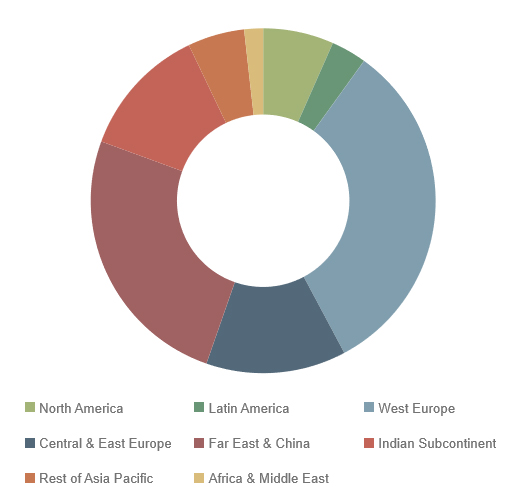

The total number of Open Banking users is set to double between 2019 and 2021, reaching 40 million in 2021 from 18 million in 2019. The ongoing Coronavirus pandemic is increasing the need for consumers to have the clarity of combining their accounts and gaining insight on their financial health, and also boosting momentum in the adoption of Open Banking.

This extraordinary growth is being driven by Europe, where the regulator-led approach to Open Banking has created a standardised market, with low barriers to entry. This contrasts with markets like the US, where a lack of central regulatory intervention is limiting growth potential.

Open Banking – Delivering Opportunities and Threats

It is worth noting that Open Banking can be both a threat and an opportunity for traditional banks. While Open Banking exposes user information and access to potential competitors, this threat has the potential to affect all players in the market equally. Consequently, established banks must create innovative Open Banking services that will provide benefits for the user, while also attracting customers from less innovative competitors.

Payments will be critical to the emerging Open Banking ecosystem; accounting for over $9 billion in transaction value in 2024. However, payments in this ecosystem are at a particularly early stage. While eCommerce is dominated by card networks, there is the potential that this role will be eroded over time by ‘direct from account’ payments. Consequently, card networks should look to offer Open Banking-enabled payment services, in order to offset the risk of future disruption.

Open Banking Users in 2021 (m), Split by 8 Key Regions: 40 Million

Source: Juniper Research