Using Trustonic Application Protection enables KB Bank to dramatically improve the authentication experience for users of its mobile banking app and allow secure high value transactions

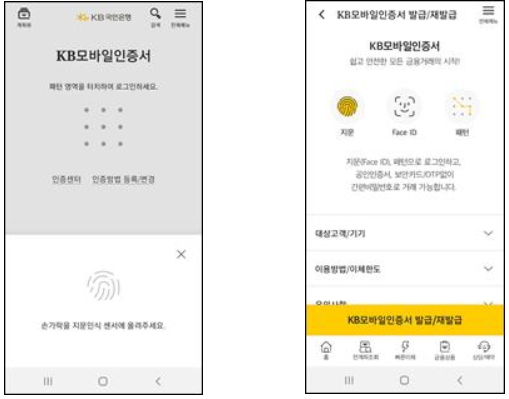

Mobile cybersecurity leader, Trustonic, today announces the successful implementation by KB Kookmin Bank (KB Bank) of Trustonic Application Protection (TAP™) to enable a simpler authentication experience for users of its KB Star Banking app. By combining TAP with its new digital authentication certificates, the bank is dramatically simplifying customers’ access to banking services and enabling them to authenticate higher value transfers in-app, without the need for cumbersome user authentication practices like security tokens.

The largest Korean bank by number of mobile users, KB Bank provides online and mobile banking services to over 10 million customers. Trustonic’s mobile application protection is enabling the bank to provide faster, simpler and more secure digital banking services by isolating authentication certificates in the hardware security of today’s smartphones. Since launching in summer 2019, the app has acquired 3 million active users, and adoption among KB Bank customers continues to grow rapidly.

Mr. Han, Senior Executive Vice President, Kookmin Bank commented: “In Korea, users need to install authentication certificates to use mobile banking services. This can be a complex and time-consuming process that often requires revalidation and multiple passwords. With our long-standing partner Trustonic, we are able to vastly improve the in-app user experience and allow our users to authorize much higher value transactions. Some security solutions make you choose between security, user experience and performance but with TAP there’s no compromise.”

Enhancing user experience & enabling high-value transactions with advanced security

Historically, public certificates need to be regularly renewed by the app user, which can be frustrating and time consuming. Now, because the new KB Mobile Certificates have the advanced in-app protection provided by TAP, they do not need to be renewed unless revoked by the customer or unused for one year. This significantly simplifies and enhances the user experience.

High-value in-app payments are now possible because of this advanced protection. KB Bank customers can transfer up to 2 million won (approx. $1,700 US) using their account password, and up to 50 million won (approx. $41,000 US) with a password and six-digit PIN. Amounts between 50 million won and 500 million won (approx. $413,000 US) can be verified by entering their password and PIN before receiving an additional authentication code via an automated phone call.

Improving in-app functionality through trust

The TAP in-app protection platform protects mobile applications by securing sensitive code, data and processes in a highly protected environment. The environment dynamically upgrades over the course of an app’s lifecycle to take advantage of the most advanced hardware and software security technologies available on smartphones. Banking, payment, acceptance and fintech app developers benefit as they can use the TAP SDK to build secure next-generation experiences.

Dion Price, CEO of Trustonic, says: “Korea’s certificate-based authentication infrastructure has historically limited the user experience for mobile banking apps. By making its banking app more seamless and secure with Trustonic’s unique combination of hardware and software in-app protection, KB Bank has vastly improved the user experience. This is a perfect example of how advanced security can enrich apps for end users, which is why TAP is being adopted to protect financial services across payments, banking, fintech and mPOS.”

For more information about how TAP is enhancing both security and user experiences, visit the Trustonic website.