Narendra Sahoo, Founder and Director of VISTA InfoSec

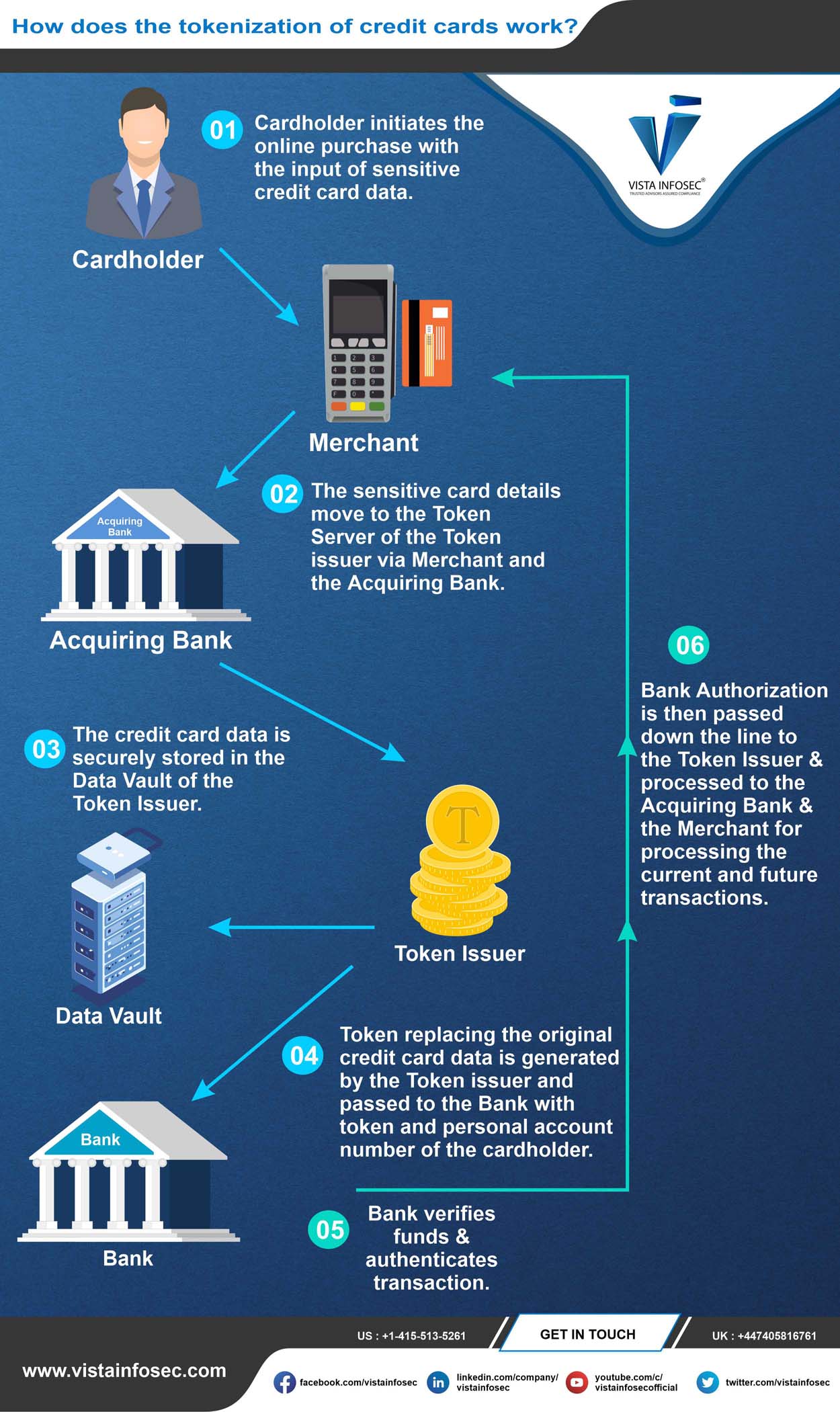

Credit card tokenization is the process of completely replacing sensitive data with a randomly generated, unique placeholder called a token. Adopting this technique removes the card data footprint from the company’s internal network and consequently reduces the risk exposure of Data Breach or Data Theft. The token ensures a high level of security for both the customer and your business during the digital payment process. Further, the token is used to access, retrieve, and maintain a customer’s sensitive credit card information as and when necessary for verification. The below-given diagram is a visual representation of the process of tokenization of credit cards.

Tokenization helps secure online shopping activities. The merchant may never actually see or store the credit card number, so even if there is an intrusion in the system by the hacker, all they can see is the randomly generated tokens. Employing tokenization is the best practice for securing card data and preventing incidents of breaches.