by Meena Jafferali – Associate Lecturer – LSBF Executive Education

In the words of Einstein: “Not everything that can be counted, counts; and not everything that counts can be counted.” We are seeing a shift towards sustainable investments and investors are considering sustainable portfolios to go with their changing ethos. So, is this the future of investments?

The trend is proving to be formidable since a study carried out in 2012 showed that high net worth individuals suggested that sustainable investment should be the choice beyond the norm of greed and motivation[1].

Investments should instead be based on deeper values of sustainable developments such as healthy goods, housing, energy and healthcare. These would all be part of the positive criteria in ethical screening that fund managers are more aware of when thinking of future investment for their investors.

In 2015, the UN set the Sustainable Development Goals (SDGs) dealing with challenges faced by nations. With 193 countries of the UN signing up to the agreement, it laid down the foundations of sustainable investing. This was further set out by The International Panel on Climate Change in 2018 stating that by 2030, greenhouse gasses need to reduce by 45% and CO2 emissions reduced to zero by 2050. Additionally, the emotional impact of COVID-19 and lockdown has seen investors becoming more socially aware and therefore looking towards ‘making the world a better place’ by rethinking their investment portfolios. It has also made investors aware of the vulnerability and resilience of the financial system.

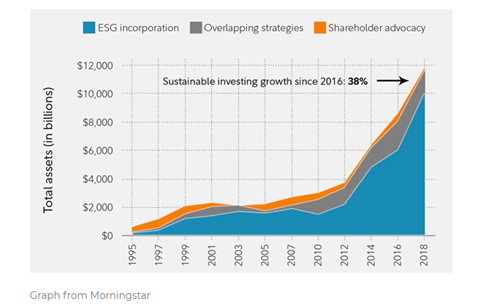

The question for an investor seeking high returns would be: Will these investments, with a sustainability filter, provide returns? We all know of the adage ‘high risk, high returns’ and this is still largely true, even for sustainable investments. However, sustainable investing is costly to research and some organisations may simply pay lip service to their green commitments. All investments carry some form of risk, even ‘risk-free’ government gilts are not entirely risk-free, but by using the framework of passive portfolio management (with positive screening), it would mean that more investors may consider sustainable investing as the future of investments. It is about finding that balance of financial considerations, short-term and long-term goals. The ever-increasing recognition of ESG (Economic, Social and Governance) factors mean that investors will be forced to consider sustainable investing over traditional investing.

What actions are needed to encourage sustainable investment? Education, education, education. It may become a common theme for educational providers to include sustainable finance as part of their course listings. This could also be achieved by encouraging new investors such as institutions, individuals and family offices to opt for sustainable investing as the future of investments by aligning financial returns with sustainability. More progress is still to be made to generate demand but where there is a will, there is a way to transform traditional investing. Post COVID-19 is the new normal, perhaps sustainable investing will also become the new normal.