By John Barber, Vice President of Infosys Finacle Europe

In the rapidly evolving landscape of the banking ecosystem, customer engagement will continue to be a critical factor shaping the competitive stance of incumbent banks. Surveying the success of the transformation efforts, a recent global study by Qorus, a Paris-based financial non-profit and Infosys Finacle, unveiled that fewer than 14 per cent of leaders at incumbent banks perceive themselves as highly successful across aspects of digital customer engagement. One might interpret this trend as indicative of insufficient effort by banks. Yet that’s only part of the story. In reality, despite sincere endeavours to elevate customer engagement over the past few decades, banks are pursuing constantly shifting goalposts.

So, what factors drive this continuous shift in the goalposts? What will allow banks to evolve and tune their digital engagement strategies in a dynamic environment? What practices can ensure success now and in the future? Can banks establish criteria for success and measure progress amid shifting benchmarks? Moreover, how can leaders cultivate an organisation that consistently excels in this ongoing digital transformation journey? I try to answer these questions here.

Constantly shifting goalposts

In the past two decades, bankers have needed to adapt their customer engagement strategy to align with customer’s ever-changing demands, the rapidly evolving channel landscape and the transformative influence of modern technologies.

Shifting customer expectations has driven banks to keep evolving their digital engagement strategy. Demands for self-service, personalisation, and contextualisation have become imperative. For example, customers want to be empowered to design products themselves on digital channels. Over time, customers also expect seamless integration of products and services into their primary journeys.

Banks have also traversed a changing terrain of evolving channels. While specific percentages might be elusive, it’s well-established that the introduction of ATMs in the 1960s and 1970s gradually increased their usage for cash withdrawals and basic transactions. However, physical branches remained the primary channel for most banking activities until the Internet revolution.

Some European countries like France and Norway were early adopters of internet banking in the late 1990s. However, the pandemic accelerated the adoption of digital channels. In Europe, digital adoption jumped from 81 per cent to 95 per cent during this time.

Recently, and looking ahead, the emergence of open banking and the integration of smart devices pose new challenges but also unlock exciting opportunities for banks to deepen customer engagement and build lasting loyalty. It empowers banks to move beyond generic products and truly understand their customers’ financial lives. Imagine targeted financial advice, proactive alerts for suspicious activity, or automatic savings plans based on spending patterns. This hyper-personalised approach creates a sense of value and builds enduring relationships. More than 50 per cent of the banking transactions are expected to originate on open banking channels in the near future. Progressive banks are transitioning from isolated transactions to a unified platform within an interconnected ecosystem, where each interaction creates a cohesive customer journey.

Then, there has been the transformative impact of modern technologies, unlocking unprecedented possibilities for customer engagement, and these technologies have been maturing rapidly. The advent of artificial intelligence, machine learning, and big data analytics empowers banks to analyse vast amounts of customer data, providing insights for personalised services and targeted marketing. Gen AI developments promise accelerated impact across personalisation, sales and marketing efforts, and empowering the bank employees. Chatbots and virtual assistants powered by natural language processing are expected to be more sophisticated in enhancing customer support. Banks find themselves navigating the open banking era to find successful ways of collaborating with third-party services. Banks can build budgeting apps tailored to individual spending habits, automated money management tools, or seamless loan applications utilising real-time financial data. Such data-driven innovation speaks directly to customer needs, fostering engagement and trust.

But building trust in this new data-sharing environment is crucial. Banks must be transparent about data usage, vigilant about security, and offer easy-to-understand controls for customers. By empowering customers and prioritising their privacy, banks can foster the trust that forms the bedrock of strong engagement.

As banks navigate this technological frontier, they must balance innovation with cybersecurity, ensuring a seamless, secure, and customer-centric banking experience in the rapidly evolving landscape.

Sound foundations and next-best practices

Banks must establish a sound foundation and adopt the next-best practices to succeed in this evolving landscape.

1. A 360-degree customer engagement model

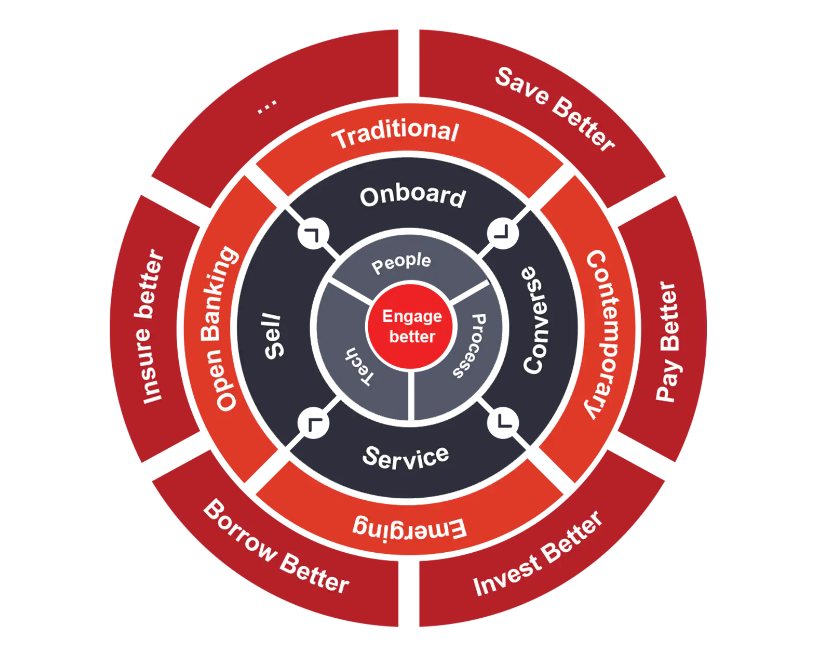

Engaging customers effectively requires a holistic approach that aligns people, processes, and technology. It is crucial to build foundational capabilities and bring them to life in the context of the customer relationship lifecycle–onboard, converse, serve, and sell. This approach ensures readiness and customer-centric interactions across traditional and emerging channels, ultimately driving financial well-being.

2. Next and best practices

a. Embrace a platform-oriented approach: Succeeding in the digital era entails perceiving customer engagement as a continuous, interconnected experience rather than isolated interactions. Forward-thinking businesses are transitioning to a unified platform within a connected ecosystem, where each interaction creates a cohesive customer journey. This shift in mindset acknowledges that every digital or in-person touchpoint is a crucial component of a larger ecosystem that shapes a customer’s journey.

b. Technology-powered innovation: Modern technologies offer opportunities for innovation and automation throughout the customer engagement life cycle. Experimentation with use cases, leveraging Gen AI, APIs, cloud, blockchain, and more enhances efficiency and innovation. During the COVID-19 pandemic, Cross River Bank’s rapid implementation of a PPP solution showcased the power of technology in serving small businesses. Cross River could extract data from documents with high automation and accuracy, completing loan application processing in as little as 8 minutes.

c. Omnichannel strategy: Banks must persist in their omnichannel strategy, ensuring their digital channel experience is at par with the platforms that customers are accustomed to. Active involvement in primary journeys and platforms through creation, participation, or partnership is essential for success.

d. Embrace renewed metrics: To stay competitive, banks must adopt new metrics for measuring digital customer engagement. Tracking user adoption rates, digital sales effectiveness, ease of navigation, and cybersecurity resilience is crucial. DBS’s “transform the bank” metrics in annual reports serve as a pioneering model for comprehensive performance evaluation.

Across these best approaches, banks will benefit by starting with customers’ primary desired outcomes and aligning with their “Jobs to be Done,” a theory on customer objectives by Harvard Professor Clayton Christensen. Banks must continually enhance the customer experience for their primary need rather than just the banking engagement. Innovative solutions spanning initiatives, channels, and journeys can drive financial well-being and empower customers effectively.

Navigating the dynamic future

Succeeding with customer engagement for banks will require a continuous commitment to adapt and innovate with shifting dynamics. By establishing robust foundations, prioritising customer outcomes, fostering a culture of experimentation, and embracing fresh metrics, banks can navigate this dynamic landscape successfully. Success in this digital transformation marathon demands a strategic alignment with shifting benchmarks and an unwavering focus on delivering exceptional customer experiences.