By Jonas Nilsson, Product Manager at Fingerprints

Biometric authentication has come a long way in recent years. Launched in the first Android smartphone almost five years ago, fingerprint touch sensors have quickly overtaken PIN as consumers’ preferred authentication method.

Now, demand for the same level of security and seamless UX is growing across other payments form factors like smartcards and wearables. But as we look to the future, it’s worth taking a closer look at how the changing size and performance of biometrics came to transform the smartphone market, and what that means for these new form factors.

Biometrics’ march into mobile

Since entering the mobile market, we’ve continually been refining our biometric technology to meet ever-evolving customer and device maker requirements.

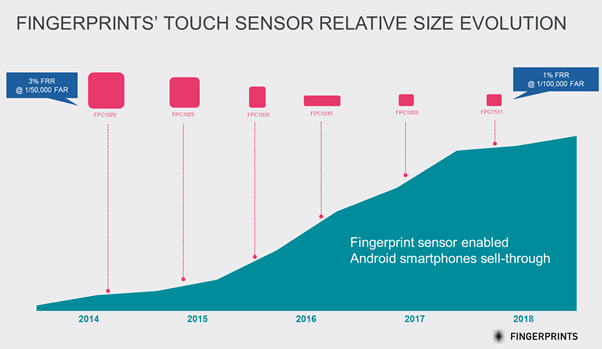

Adoption grew rapidly, seeing the number of smartphones integrating fingerprint scanners rise from 3% in 2014 to a whopping 80% in 2018. But this growth also correlates nicely with the reduction in sensor size.

Unlike other types of biometric authentication such as facial or voice recognition, which utilize a multi-purpose device like a camera or microphone, fingerprint requires a separate sensor. For device manufacturers, this posed significant technical and cost challenges.

The smaller the sensor, the lower the cost, and the more flexible OEMs can be in design and integration. For fingerprint biometrics in mobile to truly become mass-market, scaling down our sensors was not a choice, it was a necessity. But reduction in size did not equal compromise.

When it comes to fingerprint sensors, as with many things, bigger does not always mean better. Through extensive R&D, optimal biometric performance and security is possible and mass adoption is less a question of size, and more about system and biometric understanding.

Software is the key to biometric performance

Scaling down a sensor’s physical size does not impact security. And the secret is the optimization and balance of all components included; hardware and software, working in harmony.

Better software creates a better experience overall: enabling users to authenticate themselves by touching the sensor at any angle, minimizing false rejections, and most importantly, almost eliminating the chance of false acceptance.

As software for smartphone sensors has advanced, it has been possible to both reduce sensor size while improvingperformance and security. For this reason we’ve seen demand soar for our active capacitive sensors and have now shipped 1 billion worldwide.

Applying the lessons learned to payments

Success in mobile has undoubtedly set the stage for the role biometrics will play in our financial lives. To make the security and convenience of biometrics a reality for card and wearable payments, it’s important to utilize the lessons learned from mobile.

Continuing to champion the combined power of quality hardware and software remains essential to progress. With extensive R&D, sensors have become thinner, more flexible and ultra-low power enough to make the biometric payment card possible. Our software is already the best on the market, but we will continue our quest to develop even more effective sensors and software, and with time and scale make similar improvements within payment as we have seen in mobile. Sensors will get even smaller, in order to fit into new payment form factors like smart watches and rings. While sensors get smaller, the performance and security will be maintained or even increased, giving payment card and wearable manufacturers greater design and UX freedom.

With contactless card trials launched from the U.S. and Europe, through to the Middle East and Asia, and the world’s first volume order of fingerprint sensors for cards placed earlier this year, we can expect this form factor to be making its way into the hands of consumers soon.

But it doesn’t just stop there. The opportunities are endless for biometrics to be added to a range of other form factors – from wearables to USB dongles and other IoT devices.

As a final point, we as technologists are not here to dictate what sensor size banks and card manufacturers prefer to integrate. The implementation, as with mobile, will be driven by the market. However as biometric experts we know what it takes to ensure maximum performance and security in each case and will continue to drive the market forward together with our strong partners.

So, don’t get hung up on size, it’s performance that you actually desire.

Want to learn more about the work we’ve done to bring biometrics to payments? Download our latest infographic.