Tom Philbedge and Erika Hawker, banking experts at PA Consulting

For many, mobile and online banking have become an everyday part of life. But the price of digital connectivity has come at a cost through branch and ATM closures. According to Which?, from January 2015 to the end of 2023, 5,155 branches have closed or are scheduled to close, representing over half of the branches across the UK. With digital adoption increasing through the COVID-19 pandemic, and the rise of digital-only challenger banks experiencing promising returns, this trend is likely to continue and represents a real challenge to those who rely on physical banking services.

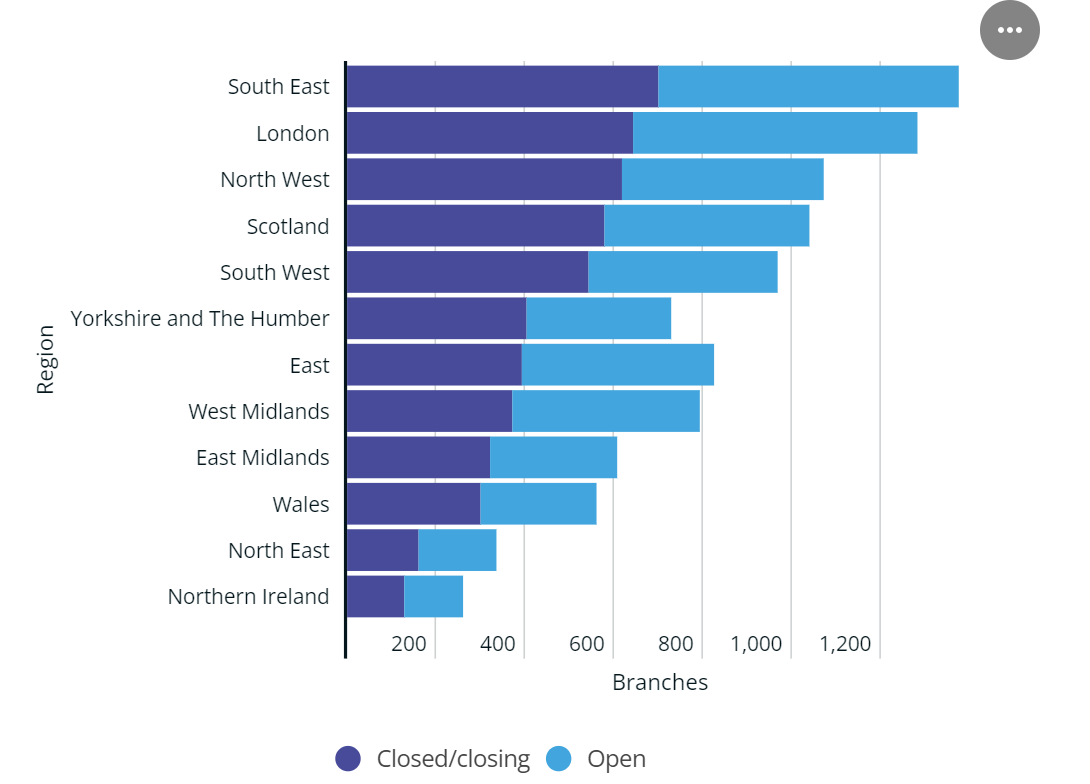

Figure 1: Breakdown of branches that have closed (or are planning to close) since January 2015 versus those that remain open (Source: Which?)

Without access to a bank, some people are at risk of being left behind, furthering the digital and financial divide. According to the FCA’s Financial Lives Survey, there are 22.5 million people still intending to use bank branches and a quarter (27%) of adults with a day-to-day account regularly using a branch.

With updated guidance on closing branches published by the FCA, it is clear that the physical banking network and cash economy is here to stay and financial services firms need to ensure they can meet this demand.

Opportunities remain open for bank branches

As people and businesses are impacted by the cost-of-living crisis – banks have an important role to play in supporting their consumers.

The greatest opportunity for banks is recognising the value of brand loyalty from branches; humans need access to humans. Branches offer a huge driver of customer satisfaction, and many people choose a bank on its branch proximity and the ability to deal with complex issues- paving a way for banks to reinvent branches as part of their corporate social responsibility (CSR). Face-to-face interactions provide opportunities including:

- Building relationships with new customers and the younger generation

Demographically, branch users include both the older and younger generations. In a survey of 150 graduates (average age 22-25) 66.1% visit a branch at least once per year, 51% chose their bank either through their parents’ recommendations or because of branch proximity and 66.1% are still banking with their first bank.

Demographically, branch users include both the older and younger generations. In a survey of 150 graduates (average age 22-25) 66.1% visit a branch at least once per year, 51% chose their bank either through their parents’ recommendations or because of branch proximity and 66.1% are still banking with their first bank.

They are seeking advice around future financial decisions such as: investing, pensions, mortgages, insurance, savings. In-branch clinics are a great way to meet this need.

- Providing financial and economic advice to retail customers

The FCA’s Financial Lives Survey showed that over 10.7 million UK adults have low financial resilience, offering in-person money and financial advice – particularly for those without access to digital banking – can help people improve their financial resilience. - Facilitating entrepreneurial workshops for local businesses

Banks can use branches to take an active role in supporting local businesses, helping to build relationships between the community, businesses, and branches including:- Providing generic business advice;

- Specific financial advice including cash flow management and suitable banking products

- Face to face digital services training;

- Hosting workshops and introductions between potential local investors and businesses looking for funding;

When branches have closed, what other solutions are there?

At present, banking hubs are one of the best alternatives to branches. 14 new hubs are set are to open in the next year bringing the total 26 across the UK. However, it will take years for enough banking hubs to replace the existing branch network and there are other things banks can do in parallel with hubs, or as alternative measures:

- Offering physical banking experiences where banking hubs aren’t set up

Some of the alternative branch solutions that are already being rolled out across the UK include:

- Self-service machines in branches for simple transactions – such as paying in cheques and deposits at Intelligent Depositing Machines (IDM)– offering a speedy way to undertake essential banking needs and manage cash with help close by if it is needed.

- Mobile branches: Banking being provided from mobile facilities, such as vans, scheduled to visit different communities on different days of the week.

- Reduced opening times for branches: Reduced opening times or days to reduce running costs, without sharing the facilities.

- Creating accessible banking kiosks

OneBank is an example that offers accessible banking kiosks for all banking brands. Utilising Open Banking technology, they allow users to access many of the key banking functions available in branch, but from the convenience of a kiosk hosted in large shopping centres or high street shops.

- Customer technology upskilling

Upskilling around digital must continue at pace, with a focus on helping those who may need additional support to adopt technology. Offering training is also a direct line of communication, and an opportunity to capture direct feedback to ensure banking experiences are accessible for all.

What do banks need to do differently?

Capitalising on branch opportunities is certainly not an overnight feat but by incorporating branches into their CSR strategies, branches start to offer value in other ways including:

- Improving banking access to those who need it most;

- Offering retail advice to improve the UK’s financial literacy and mobility for those who can’t access online advice;

- Providing local businesses with entrepreneurial support;

- Regular free money advice and budgeting sessions;

- Improving the UK public’s trust in the UK’s banking system.

Eventually, leading to:

- Improved customer satisfaction;

- Higher retention of customers;

- Reduced chances of retail and business customers defaulting through advice.

However, banks will still need to consider the cost of keeping branches open. Partnering with other common high street facilities, such as coffee shops or supermarkets, can help with overheads such as rent and utilities. Similarly, banks will need to proactively help the banking hub agenda through funding and providing proactive insights on branch closures.

Amid an unprecedented cost-of-living crisis it will be crucial for banks to restore their status as a symbol of trust, which means understanding that human beings use branches for a plethora of different reasons and that reliance on banks for support during this time will be crucial.