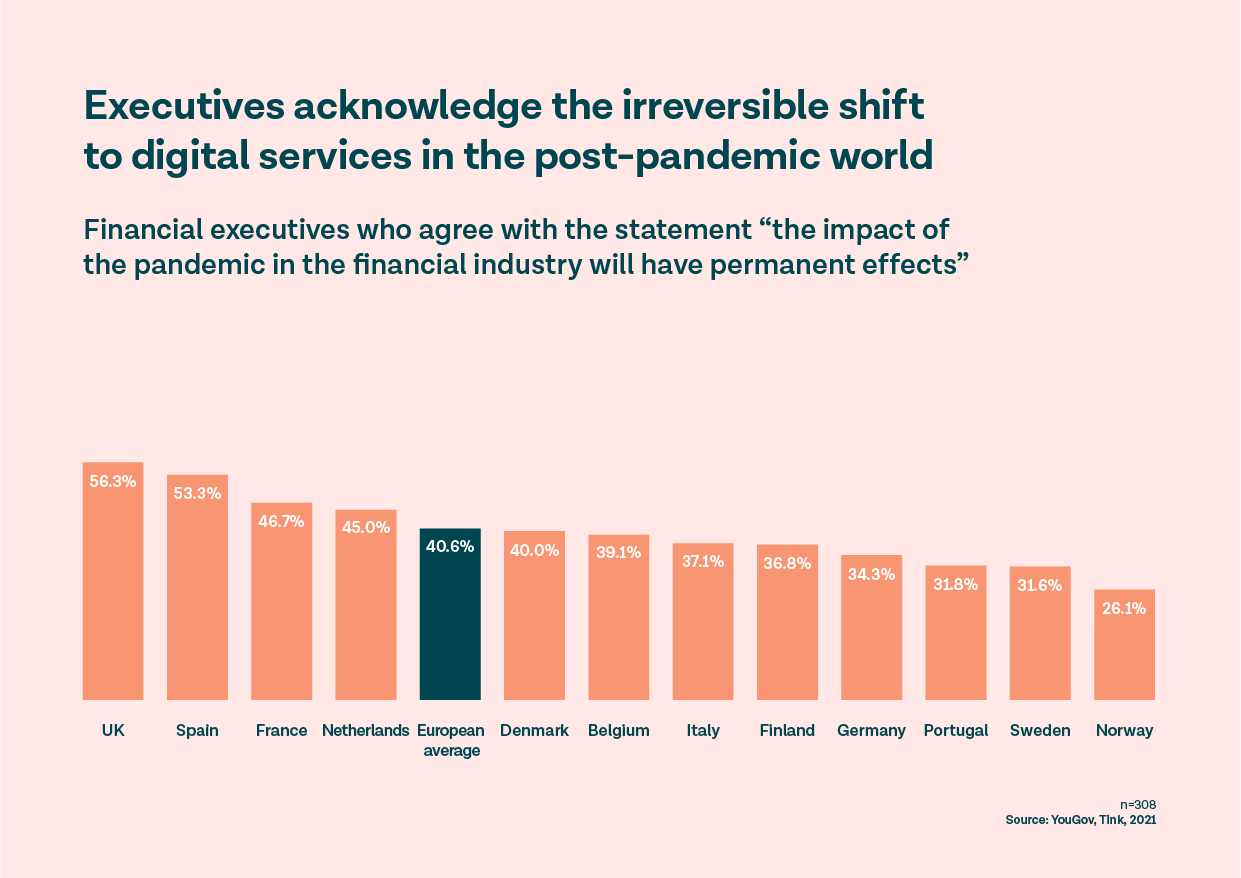

- European executives acknowledge the irreversible digital transformation in the financial services industry accelerated by the pandemic.

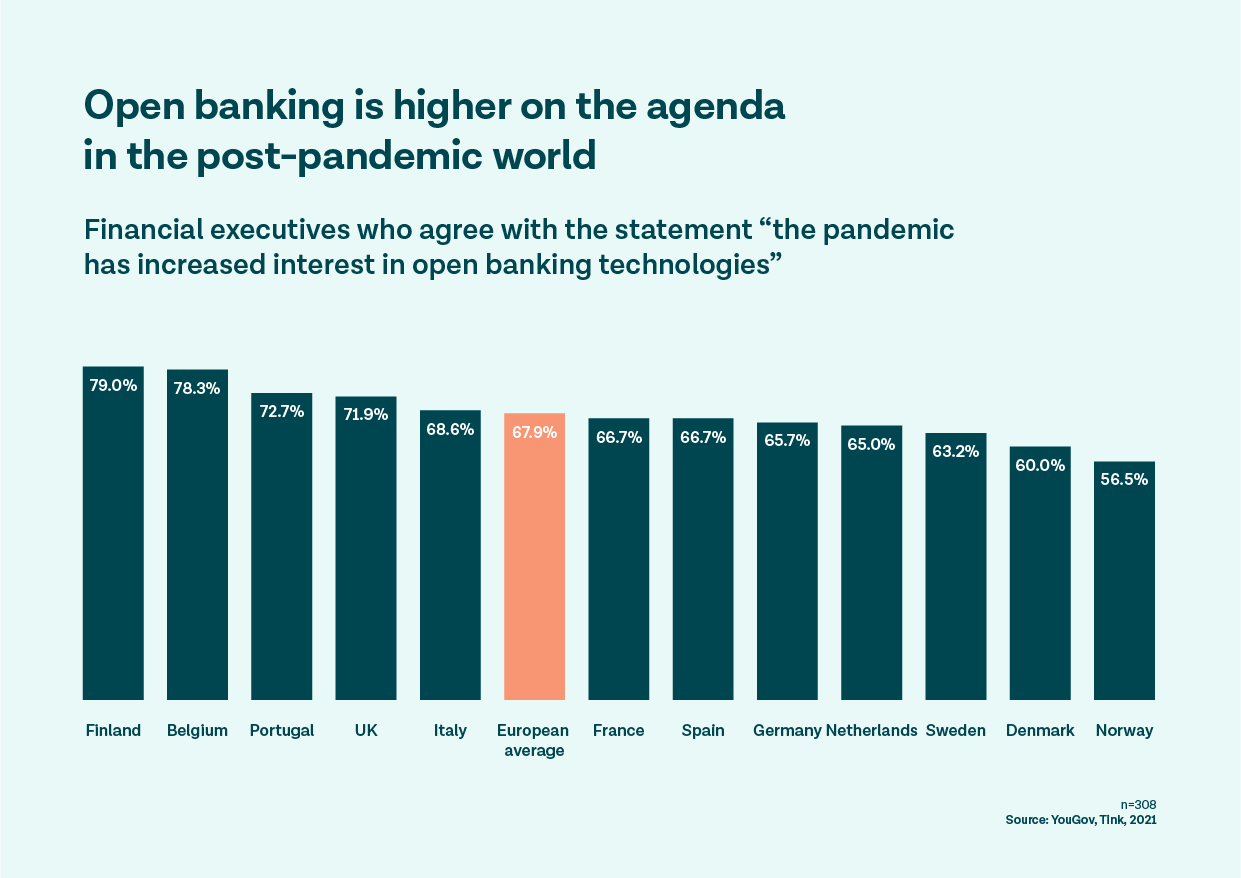

- Over two-thirds of financial executives say the pandemic has increased their focus on open banking.

- This shift is propelling banks to concentrate their efforts on the creation of digital services, on improving the customer experience and restoring profitability.

- Yet only 67% of financial executives believe Covid has increased business risk, despite clear signs of looming economic challenges.

A new report published today from open banking platform Tink suggests that Covid-19 has irreversibly increased the shift to digital financial services.

As a result of the pandemic, financial institutions have been forced to adapt to more digital ways of serving their customers, while people across all age groups have had to become familiar with using more digital services. This has led to the digitalisation of financial services being fast-tracked – and 41% of European financial executives believe the effects of the Covid-19 pandemic on the financial services industry will be permanent.

Open banking gets a boost

Even in light of the digital transformation efforts that have been set in motion over the past few years, 65% of financial executives across Europe still believe that banks need to increase their speed of innovation. This digitalisation shift has resulted in an increased appetite for financial institutions to leverage technology and find solutions to new challenges as a result of Covid-19. In fact, more than two-thirds (68%) of European financial executives say their interest in open banking has increased during the pandemic.

The report also shows that the pandemic has focused European financial institutions on three key business priorities. Three-quarters (74%) of executives see an increased need to enhance their digital services – to streamline onboarding and manage more customers digitally. While 70% are also focused on the customer experience – to differentiate themselves from competitors and boost customer engagement in an increasingly digital world. For 68% of financial executives, there is an increased focus on restoring profitability, through automating and streamlining business processes.

Lasting long-term impact or short-term blip?

However, despite the big shifts the financial services industry has witnessed during the pandemic, 59% of financial executives still see the transition to digital as a short-term blip and expect things to return to normal. Similarly, only two-thirds (67%) of respondents think that Covid-19 has increased business risk, despite clear signs of looming economic danger on the horizon – with households under increasing financial distress, non-performing loans set to rise and businesses at risk of bankruptcy when governmental support runs out. This suggests that some European financial institutions are at risk of sleepwalking into a future of unforeseen challenges that may have a severe impact on their customers, unless they recognise the significant and lasting impact that Covid-19 has had on the financial industry.

Daniel Kjellén, co-founder and CEO, Tink, said: “The pandemic has forced many executives to remedy the lack of personal interaction with customers by focusing on delivering digital services. But this has also provided a way of creating more value for the customer, while increasing insights to identify or even predict potential risks and new demands. Financial institutions have seen that open banking technology presents opportunities to increase the speed of innovation, introduce new commercial streams and revenue opportunities, while enabling operational efficiencies that will benefit their business long term.