By Professor Catherine Karyotis, NEOMA Business School and Joseph Onochie, Zicklin School of Business, Baruch College, City University of New York

The current global health crisis is a reminder that finance must help build the world of tomorrow, provided it is green and inclusive.

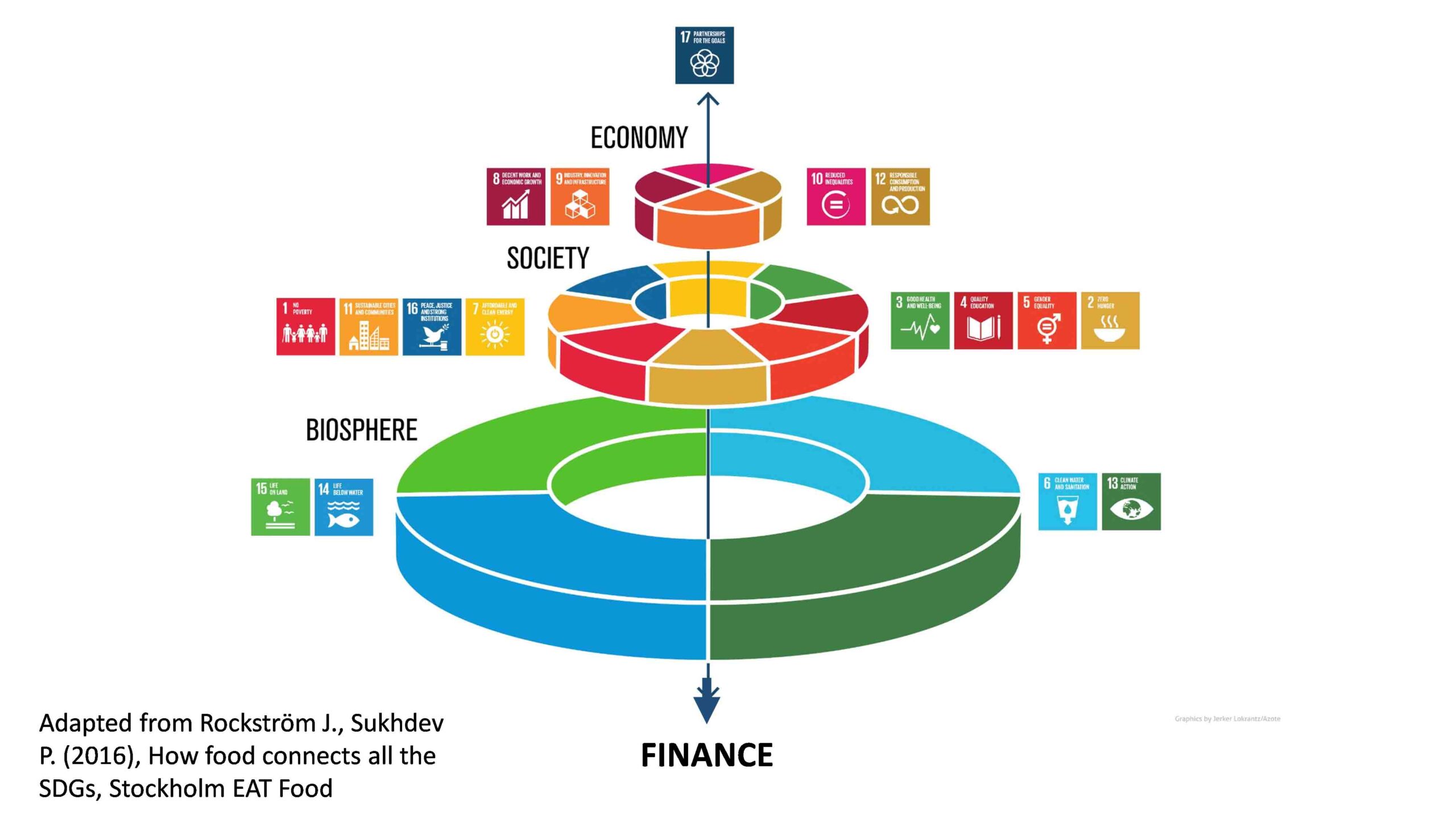

So, what is the role of finance? To serve the real economy, society and the biosphere. An economy can only be solid and sustainable if it is based on a healthy population, which in turn can only survive on a healthy planet.

Finance must be guided by the UN’s Sustainable Development Goals

So how do we rebuild the post-Covid world by meeting societal expectations? By taking the UN’s Sustainable Development Goals (SDGs) as a roadmap for finance.

Speaking to attendees of the “UN Global Compact Leaders’ Summit” on 21 September 2019, Paul Polman (ex-CEO of Unilever) remarked, “Business cannot be a bystander in a system that created it in the first place… In implementing the SDGs, as in any change process, there will be bottlenecks, setbacks, cynics, sceptics. It takes courageous leadership. That’s where the breakthrough comes from: from people who understand that putting the interests of others ahead of their own is actually in their own self-interest.”

Globally, many institutions have chosen to use this model of the SDGs from AFD – Agence Française de Développement (French Development Agency). This model groups the 17 SDGs into six transitions: energy, demographic and social, digital and technological, economic and financial, territorial and ecological, and political and civic.

A business plan for finance based on the SDGs makes it possible to direct financial flows towards multiple targets; for example, financing infrastructure useful for water sanitation (SDG 6) makes it possible to act on the health of populations (SDG 3) by improving terrestrial and aquatic life (SDG 14 and 15) in order to contribute to economic growth (SDG 8 and 9). The SDGs are indivisible and cross-cutting; they concern all economic actors in all countries; they are sources of universal language.

The pandemic has accelerated the link between finance and sustainability

This role of finance as seen through the lens of the SDGs has become even more apparent since the global health crisis. In August 2020, GISD – Global Investors for Sustainable Development published a report with 64 recommendations to encourage sustainable finance to better target the SDGs, of which 10 are priorities: addressing systemic sustainability risks, improving ESG data and ratings, complying with transparency and harmonisation requirements, strengthening corporate governance, strengthening public-private partnerships, developing sustainable finance products and infrastructure.

The instruments exist: green bonds, social bonds, sustainable finance, responsible investment, impact investing, etc. From now on, we must put the long-term dimension back into financing and investment, so that we can reconcile financial profitability with social and environmental profitability.

An economic model that places human and environmental sustainability at its centre

Former World Bank Group chief financial officer Bertrand Badré suggests “Now is the time to think big. In 1944, while World War II was still raging, representatives from governments around the world gathered in Bretton Woods, New Hampshire to start planning for what would follow it. Following that model, we should be preparing a new Bretton Woods for sustainability. When one is being buffeted by a storm of this magnitude, the worst thing one can do is lose one’s compass. But we must use that compass to chart a new course towards an economic model that places human and environmental sustainability at its centre”.

Joseph Onochie is Associate Professor of Finance at the Zicklin School of Business, Baruch College, City University of New York (CUNY). He teaches, and conducts research, in diverse areas of Finance.

Catherine Karyotis, is a Professor of Finance at NEOMA Business School in France