By Mark Shields, Director of Solution Marketing at Appway, an FNZ company

The regulatory outlook in the financial services sector is complex and highly dynamic with major changes taking place in several areas, including ESGs, transparency, data security and cryptocurrency.

In the EU, for example, the Sustainable Finance Disclosure Regulation (SFDR) has been effective since March 2021 and has set new high standards on disclosures and introduced the requirement to report adverse investments’ impact on social and environmental issues. Similarly, in the US the Security and Exchange Commission (SEC), has taken on the “mission of protecting investors, maintaining fair, orderly and efficient markets and facilitating capital formation”, and is currently exploring the introduction of climate risk disclosure and ESG related claims, that will require collection and management of large amounts of data. Significant upheaval is expected to take place around the globe in Japan, Canada, Benelux, Australia, US and France. In addition to this new and constantly changing regulatory landscape, investors and wealth managers, especially in the US, have to face the possibility of new tax rises which will exacerbate an already challenging outlook

Not only is there incredible pressure on wealth managers, insurers, advisors, and banking businesses to adhere to a range of changing regulations, but they must do so without losing sight of growth and profitability. Specifically, they need to ensure that they continue to attract new customers and offer an excellent customer experience, while delivering on transparency and compliance.

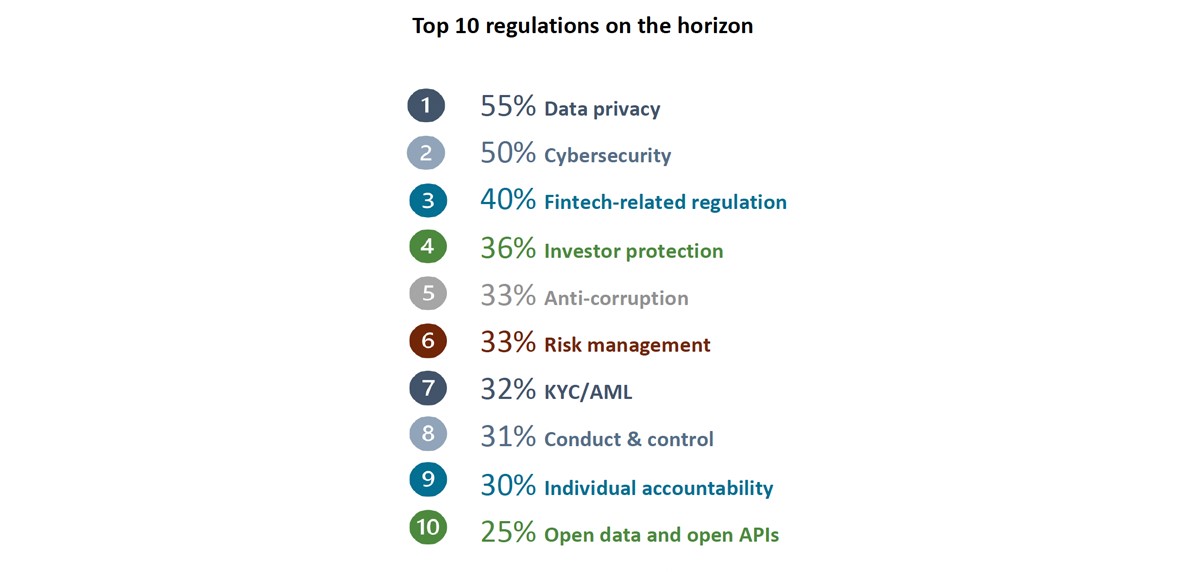

Recent research by ThoughtLab, , Wealth and asset management 4.0- How digital, social, and regulatory shifts will transform the industry, delves into wealth management professionals’ outlook for the next two years and found that the top areas for regulatory change are expected to revolve around: data privacy (55%), followed by cybersecurity (50%), other fintech-related regulation (36%), investor protection (36%), anticorruption and risk management (33%).

Typically, all these areas for concern in the next 24 months heavily impact data collection and require that advisors and the back office are particularly careful in correct reporting and transcribing of data. In short, the risk of human error is particularly high when assessing compliance factors for these different areas of upcoming concern.

The important role played by top quality data management should therefore not be underestimated, weaving regulatory compliance seamlessly into the high-end service of private wealth management requires process accuracy but also awareness of customer experience.

Filling out documentation to build customer profiles and ensure transparency can be tiresome and complex for investors, who will be even more put out if they must repeat the process due to a minor omission or mistake. Yet when processes are carried out manually, there is a high risk of human error, sometimes simply caused by an illegible file or an accidental omission. Add to this the fact that clients often have to input the same data again, such as in occasion of a periodic review, and it is clear that data collection and verification is a thorn in the advisor’s side.

To help safeguard customer experience while ensuring complete compliance, savvy wealth management firms are opting for greater automation and compliance by design processes in swathes. To guarantee accurate, transparent and secure data collection process and hassle-free compliance for their clients, wealth managers need to start implementing flexible solutions that will allow them to digitize and automate clerical processes, such as client onboarding, and to deal with future regulation changes swiftly and efficiently, without impacting client engagement. Failing to step up to the challenge today may result in customer churn and lost revenue, a dramatic- but not unimaginable- scenario that any business needs to be prepared to avoid.