Banks come eighth in the CallMiner Index – down from sixth over five years

Consumers want to stay loyal but bad practices with new customer offers and bad call centre experiences drive people away

London, United Kingdom, 25th July 2018 – New research released today by CallMiner, the leading platform provider of award-winning speech and customer engagement analytics, reveals that British businesses are driving customers away for completely avoidable reasons. And it’s costing them billions. In fact, a conservative estimate of the price of switching is £25.05 billion per annum.

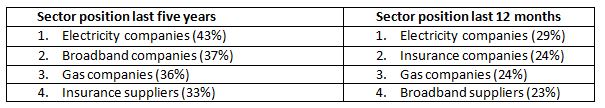

The report features survey responses from 1000 UK adults who had contacted a supplier in the last 12 months. Entitled the CallMiner Index, the report shows that 84% of adults switched suppliers 1.91 times in the last 12 months. The sectors that top the CallMiner Index over the last five years and the last 12 months, are:

The same four sectors top the Index over five years. The banking sector has moved lower in the Index in the last 12 months, to eighth position from six over five years.

The pace of switching is on the rise

The CallMiner Index also looks at how often people have switched over the last five years by sector. The average rate of switching across all sectors is 3.4 times over five years or 0.68 times per annum on average. When you consider that the average rate for the last 12 months was 1.91 times, the rate of switching has accelerated by almost three times! But banks have the second lowest average out of all sectors, with bank customers switching three times in the past five years.

The main reasons for churn – falling foul of the Brits’ sense of ‘fair play’

The survey uncovered that consumers want to stay loyal but are ‘forced’ to switch because of suppliers’ bad practices. There is a difference between plans to switch and actual switching. For example, only 10% say they are planning to switch banks but 12% did so this year. This gap between intention and action can be seen across all the sectors.

The main actions by banks that force consumers to say goodbye are as follows:

- Prices are too high or have increased (69%)

- There is no reward for contract renewal i.e. no reward for loyalty (44%)

- Discounts offered to new customers are not automatically applied to your account (40%)

- Feeling like you are not being treated fairly (31%).

After price – which is an inevitable reason to change – the next three on the list are all related to being treated unfairly. Not only is this counter to the famous British sense of ‘fair play’, but neuroscientists tell us it falls foul of a primary need that is hardwired into our brains – being fairly treated. Amy Brann, a leading neuroscience expert at Synaptic Potential, explains: “Being unfairly treated triggers a response in similar networks of the brain that control physical pain. The reaction can genuinely hurt! That’s why people will go to great lengths to right wrongs. In the case of suppliers this can include burning lots of time in having a complaint handled, defecting to another company, bad mouthing the supplier online and offline and in more extreme cases, pursuing legal avenues.”

Unsurprisingly, the advice banking consumers provide on how to keep them loyal matches the top three reasons for switching. However, the strength of feeling is indicated by the fact that more people provide this advice than those that switched for the same reason: keep prices the same or better than for new customers (79% v 69%); reward them for renewing their contract (69% v 44%) and automatically apply new discounts to their existing account (61% v 40%).

Frank Sherlock, Vice President for the UK at CallMiner said: “With 84% of people switching in the last year, churn has reached epidemic proportions. And three of the top four reasons all relate to fairness. Treating people unfairly is completely avoidable. Banks could reduce their churn rates still further if they listened to what consumers are saying in this research and put treating customers fairly at the heart of their brand values.”

Banks not seen as good at recognizing vulnerability

Thirty percent of banking customers scored between 0 and 4 (when 0 is not at all good and 10 is extremely good) when asked how good they think banks are at recognising when a customer may be vulnerable/need sympathetic handling (such as when they are in debt or contacting to handle things related to a deceased family member).

Call centres are now centre stage in the battle for loyalty

The telephone remains the preferred way to contact suppliers and is subsequently the #1 channel used. Almost a third (32%) of banking customers list the phone as their first preferred method to interact with their bank. However, double the number of consumers (64%) used the phone to contact banks in the last year. This may be because the top two reasons to contact banks relate to problems with charges (65%) or resolving a technical problem with the product or service (60%). Both these issues require specialised support from a contact centre agent. Issues around charges fall into the category of avoidable triggers for churn.

Call centre experience can decide if consumers stay or say goodbye – empathy is key to success

When it comes to delivering services to keep banking consumers loyal, call centres top the list: 69% want call centre staff to be aware of their service history so they don’t have to explain multiple times.

The survey also uncovered that call centres play a pivotal role in a consumer’s decision to switch or stay loyal. When asked how likely they are to switch their banks if they have a bad experience with a call centre, 72% scored between 7 and 10 on a 0 – 10 scale (where 10 = extremely likely). This is 4% more than the whole sample. About one in five (22%) scored 10. When asked how likely they are to stay loyal to their bank if they have a good experience with a call centre, (71%) scored between 7 and 10 – 3% lower than the whole sample – with 20% scoring 10.

The ability to show empathy seems to be key to success. When asked about their emotional state before a call to a call centre, the top response by 44% of banking consumers is that they want someone to listen to them. The next four answers show what a tough job call centres staff have in dealing with the emotional state of callers. Two fifths (40%) say they arrive annoyed; almost a third (31%) arrive hopeful; 21% arrive confused and the same number arrive ready for an argument!

It seems some call centres are good at taking the heat out of the situation. The second highest response for the emotional state after the call, by almost one third of banking consumers (32%), is satisfied. The percentages of people feeling angry, annoyed or upset, all show reductions of an average of 28% from the before-call figures.

However, other call centres may be less empathetic. The highest response by over one third of people (36%) is feeling frustrated and third highest (28%) is feeling annoyed. Despite reductions in negative emotions post call, the percentage is still high with 58% of customers reporting negative emotions (Angry, Annoyed, Upset, Confused, Frustrated) after contact with a call centre. When it comes to meeting consumers’ need to be listened to, banking companies do not perform as well as consumers would like. In fact, less than half of those who wanted to be listened to before the call (44%) felt that they had been after the call (20%) – meaning they left the call feeling ignored.

Aimee Lucas, Vice President and Customer Experience Transformist, at Temkin Group, said: “Our own research shows that call centre interactions that were more emotionally negative led to longer calls, more frequent transfers, and lower likelihood of the customer recommending the company to others. It’s imperative that companies use the available tools to their advantage to identify reasons leading to negative customer experiences and churn and coach their call centre staff on the behaviours that create more positive interactions with customers.”