By Cherry Wang, Country Manager, UK & Ireland, Homelike.

Business travel accommodation is undergoing drastic changes as the sector moves into a new era focused more on travellers’ well-being and health. Following a year of uncertainty, restricted people movement and the wide adoption of remote working, perspectives of what makes a business trip worthwhile has adapted. Corporate travel managers now need to consider leisure time for the traveller while keeping budgets affordable, with flexible booking policies and wider choices of locations, including beyond traditional commuter cities.

As the world begins to return to normal, one of the biggest shifts we’re seeing is the significant reduction in budget spend of traditional customers. Where large corporates once had an almost unlimited budget, these have more recently become similar to that of an SME. The Global Business Travel Association (January 2021) reported that 90% of travel managers and procurement professionals said they think their companies will spend less on travel in 2021 vs 2019, with an average budget decline of 52%

Visible change in corporate travel

The way companies are considering how they view business travel and its importance is also changing. Care and attention to the health and safety of employees is becoming a higher priority than the need for face to face contact. Key changes have included:

Travel policies – More attention into which trips are really necessary for the company and the potential return on investment/risk

Corporate COVID policies – Duty of care is now one of the top elements for TMCs and corporates, with the increased usage of tracking tools and COVID update data.

Employee welfare – Employees physical and mental wellbeing has become a top priority, with more autonomy for the travellers to decide whether or not travelling is safe and necessary

So ultimately what does this mean for businesses, employees and the accommodation sector? Businesses will need to be increasingly flexible in their approach to staff and work locations, and understand that some workers may be more inclined to travel away from home if it can be more of a ‘workation’, where they can take their family along too.

More hospitality operators are ready and willing to cater for this growing demand, with the introduction of new measures such as subscription stays, where companies can pay a set rate for use of one or more properties without any further costs. A number of hotels and other accommodation providers have already introduced subscription based offerings to appeal to remote workers and digital nomads. Intercontinental Hotels Group, Marriott, Accor, Zoku, and hostel brand, Selina, are just some examples of hospitality operators embarking on this trend.

In the same vein having a ‘home away from home’ is something business travellers are looking for from their accommodation. This is where apartment rentals trump hotels as they are able to provide all the comforts of home including a deskspace, fast internet and kitchenette, making serviced accommodation and the extended stay sector much more in demand.

Business travel is also keeping alive the accommodation sector in core cities, where a lack of leisure travellers has meant an increase in rooms available. This trend is driven by those who moved away from core cities during the pandemic to secondary cities or even rural locations. This has ultimately led to a demand for business accommodation in the biggest cities as the return to work occurs and people need to be back in offices in the likes of London, Edinburgh, Manchester and Birmingham.

How we interact with our accommodation providers and ultimately pay for it has also changed considerably in the last 12 months. Contactless is a trend fuelled by Covid, that will be here to stay. Businesses have been quick to adapt to this form of technology and communication, creating a seamless experience for the end user. Most commonly we have seen:

- Automated communication (text and email)

- Smart device access to accommodation via app or Link (Hilton have been leading the way on this, also Sonder)

- Payment and procedures carried out online and digital guest identity checks via an app or digital form (Your Apartments)

The future:

As for where we see the corporate and leisure accommodation sectors in the future, it’s clear many of these latest trends are here to stay. 2021 is likely to still be a year filled with travel uncertainty with continued focus on flexibility, digitisation and safety / duty of care.

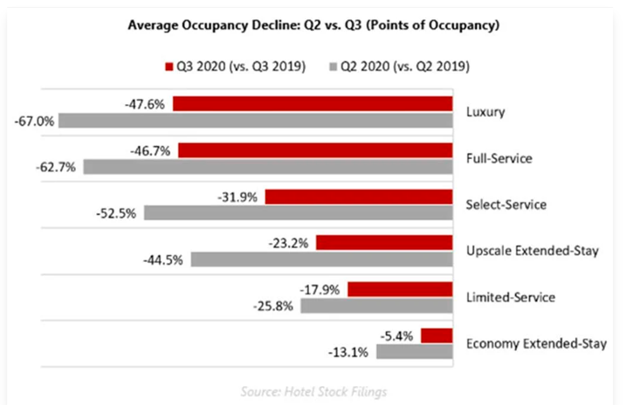

We can already see this taking place in the extended stay sector from hotel groups, which has increased their investment in this type of accommodation. The resilience of the extend stay sector during the pandemic, in addition to the lower operating expenses and higher occupancy rates means that there is a strong pipeline currently under development (see occupancy rates of luxury vs economy extended-stay hotels below)

With this investment, we will see a number of new on-going future trends which will drive forward how the mid-to-long term accommodation sector is utilised and booked.

- Digitisation: We’ll see more and more companies utilising technology to operate the business from booking through to staying.

- Flexibility: will become the new normal for corporates and business travellers, especially given the pervasive uncertainty around regulations and restrictions. Insurance policies need to be able to cater to this and the ever changing needs on their customers

- Blurring of business and leisure travel: It’s time to start thinking of these as one in the same. As more and more people mix business and leisure travel, we’ll likely see changes in the way businesses are built and operated..

- Demographic of business travellers: Step away from the views of a business traveller being a typical white collar worker. Embrace the fact that a huge source of demand will come from alternative sources; people working in entertainment, construction / infrastructure, medical industries.

In summary, it appears that it will be the accommodation providers that will have to be flexible and nimble in their approach to a new era of business travel and accommodation – putting the needs of customers above growth and profitability. This should in return mean great choice, flexibility and pricing for bookers.