By Katie Jameson, Director of EMEA Marketing at Act-On Software

Marketing in the financial services industry has completely transformed in recent years in response to quick technological advances and rising consumer expectations for streamlined, personalised digital experiences. With 81% of consumer financial research now beginning online and 7 out of 10 people doing their banking digitally, financial institutions find themselves needing to meet their customers where they prefer to engage.

The answer to these rising demands is clear. In order to get in front of your target audience, stand out from the competition with relevant and valuable content, and engage with them to gain their business, you need digital marketing tools and workflows that enhance the customer experience. Furthermore, the technology tools help you, as a marketer, automate manual and laborious tasks like segmenting contact lists, optimising landing pages and email templates, sending out communications, scheduling content, and qualifying leads.

And while technology has proved to be a game changer for marketers, the sheer number of available tools can make anyone’s head spin. How do you know what’s the best fit for your business? What’s worth investing in? What’s essential for business growth and what’s considered “nice to have”?

There is a notable difference between using low-priced technology that tackles basic everyday tasks vs. investing in technology that supports the financial institution’s bottom line and drives ROI. If your MarTech stack is a frankensteined collection of freemium tools that help you get by, seriously consider the long-term impact and whether it truly bolsters the customer experience. While this approach may meet immediate needs, it lacks opportunity for sustainability and growth that digital marketing is designed to achieve. Choosing the right technologies and software vendors help maximise internal resources and set the business up for success in the long run.

How to Identify the Right Tools and Vendors For Your Business

No matter your specific business goals and amount of resources, there are three must-have aspects to look for in a valuable software tool and vendor partner. In order to implement a long-term digital marketing process that meets customer expectations, ask both yourself and potential vendors these questions:

- Scalability: Will the technology scale to meet your needs in the future?

- Training: How much training will be needed across the organisation? How much support is available?

- Reporting: Will your chosen platform produce reports that everyone in the business will understand?

- Integration: How easy is it to integrate your platform with the other MarTech products that you use or may want to use?

- Future-proofing: What does the vendor’s roadmap for its platform look like, and does it match your company’s goals and ambitions?

Now for the question of the moment: What kind of technology tools meet these criteria? The simple and honest answer–marketing automation.

A marketing automation platform is the digital marketing engine of a business, and the biggest impactful step toward enhancing the customer’s digital experience. The robust tool serves as an all-in-one marketing software hub that enables users to develop, launch, track, report, and optimise your campaigns from a single convenient source that integrates with your CRM and other essential marketing and sales tools. The marketing automation solution provides segmentation and personalisation capabilities to help financial marketers understand the distinct behaviours, interests, and needs of your target audience and deliver the experience, services, and recommendations your customers expect.

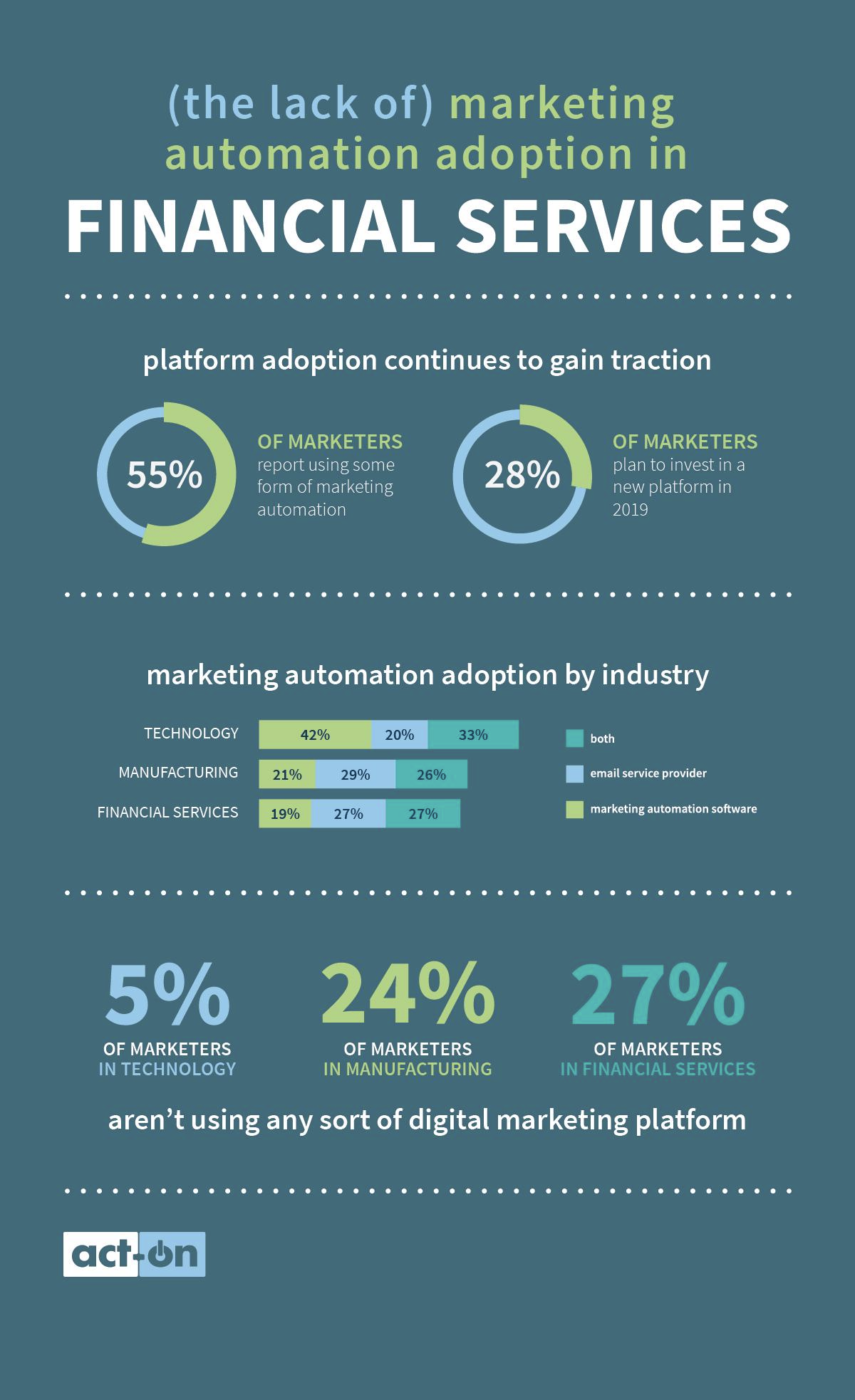

However, the financial services industry has admittedly been slow on the uptake of implementing this software solution into their digital marketing efforts. According to the 2019 State of Marketing Automation, 27% of marketers in financial services aren’t using any type of digital marketing platform, though 48% are planning to purchase some form of digital marketing software in the next year.

The Distinction Between Marketing Automation Software and Email Service Providers

Both marketing automation software and email service providers fall under the “digital marketing platform”; however, it’s important to establish the difference between the two.

Email marketing platforms enable marketers to grow their contact lists, automate communications, and mass email to their customers and prospects. However, between consumers having higher expectations for personalised communications and inbox service providers (Google, Microsoft, etc.) discouraging the batch-and-blast approach, these email marketing platforms are no longer a long-term and scalable solution.

Marketing automation software, on the other hand, goes far beyond email automation with the introduction of lead generation and personalised customer experiences. This is what ultimately drives results, and with The State of Digital Growth reporting that 87% of financial brands do not have a lead generation powered by marketing automation, there is a massive opportunity to advance your financial brand’s digital marketing maturity ahead of the competition.

Real Numbers, Real Results

When the right technology tools are leveraged, the marketing results speak for themselves and, in turn, drive business growth and sustainability.

For instance, with marketing automation, TruStone Financial Credit Union averages 68.8% open rate on nurturing emails and up to 83.3% for highly-segmented emails. There is a big appetite for personalised information and this kind of sophisticated segmentation creates opportunities for customer interaction that moves them along the buyer journey. Similarly, Tower Federal Credit Union saw a two-three times increase in their open rates, especially in follow-up emails, since implementing marketing automation, which has led to customers starting more loan applications.

AuditFile, the world’s leading provider of cloud-based audit management solutions, achieves conversion rates from trial sign-up to paid customer, three times the industry average of 20-25%, thanks to the experience customers receive through their marketing and while using the software.

Financial marketers already have too many things on their plate to navigate mismatched, short-term software tools, which do not benefit the business’s overarching objectives. It’s time for financial institutions to fully optimise their marketing practices with technology designed to drastically improve effectiveness, efficiency, and productivity.

About the author:

Katie Jameson is the Director of EMEA Marketing at Act-On Software, a leading provider of marketing automation and one of the fastest growing tech companies in North America. She has previously implemented, integrated and executed programmes on a variety of marketing automation platforms at industry leading companies such as Symantec, Paywizard, and ResponseTap.