By James Robson, CEO of FundOnion

As headlines about economic growth, inflation, and interest rates continue to dominate the news, it is important to note that each of these are both causes and effects of global business lending. How easy it is to get growth finance affects all aspects of the economy, luckily this process is set for a revolution, thanks to the now near ubiquitous influence of AI.

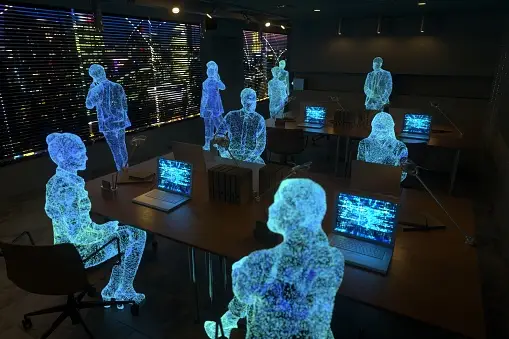

In the ever-changing landscape of business finance, AI is emerging as a transformative force, poised to shake up the way companies access capital forever.

The Future of Business Loans

The future of business loans is marked by a shift towards efficiency, speed, and precision. Traditional lending processes have often been marred by lengthy approval timelines, cumbersome paperwork, and a one-size-fits-all approach. AI promises to streamline these processes, making them more agile and tailored to the unique needs of businesses.

The emergence of AI-powered lending platforms will enable businesses to access capital with unprecedented speed and accuracy. These platforms will leverage machine learning algorithms to analyse vast datasets, swiftly assess risk factors, and determine creditworthiness. This not only expedites the loan approval process but also ensures a more nuanced understanding of each business’s financial health.

A fundamental area of development will be an ability to predict when a business is going to need finance ahead of time. For most entrepreneurs, applications for finance are thought about at-need, which is often either too late or not an efficient use of capital. By harnessing the ability of AI, businesses will be given enough notice to plan for an injection of capital at the right time.

The Role of AI in Business Loans

AI represents a tangible transformation in the way financial institutions interact with borrowers. Machine learning algorithms, a subset of AI, analyse historical data to identify patterns and predict future outcomes. This capability significantly enhances risk assessment, enabling lenders to make more informed decisions. This could be transformative, with a report from The Bank of England stating all the way back in 2019 that “the application of machine learning (ML) methods has the potential to improve outcomes for both businesses and consumers”.

One of the key benefits of AI is its ability to provide personalised solutions.

Traditional lending models often apply generic approval criteria, resulting in many deserving businesses being overlooked. More than this, it can often lead to businesses feeling they have no finance options, when all it takes is an adjustment of the repayment timeline, interest, or guarantee.

AI, on the other hand, tailors its analysis to the specific characteristics of each business, considering factors such as industry trends, market conditions, and even the macroeconomic environment.

Moreover, AI-driven lending platforms will continually evolve and learn from new data, adapting to changing market dynamics. This approach ensures that businesses receive the most relevant and up-to-date financial solutions, fostering an environment of adaptability and resilience.

Importance of Business Loans in SME Growth

In today’s economic landscape, business loans are more critical than ever, especially for SMEs who form the backbone of our economy, driving innovation, creating jobs, and contributing significantly to GDP. However, these enterprises often face challenges in securing the necessary funding to fuel their growth ambitions.

Business loans provide SMEs with the financial infusion needed to expand operations, invest in technology, hire talent, and navigate the complexities of modern markets. In an era where agility is paramount, timely access to capital can be the difference between stagnation and expansion for many SMEs.

The marriage of AI and business lending is poised to reshape the financial landscape, offering a more efficient, personalised, and dynamic approach to capital allocation.

As SMEs continue to play a crucial role in global economies, the importance of fostering their growth through accessible and intelligent business loans cannot be overstated. The future of business lending, driven by AI, holds the promise of not just transforming financial processes but also propelling businesses towards unprecedented levels of success and sustainability.

Here at FundOnion, we are seeing the rapid change that AI in commercial finance has brought to the industry. For the first time, we are seeing data-driven approvals allowing lenders in the market to provide faster – and indeed sometimes instant – credit approvals for SME borrowers. This increase in speed not only benefits lenders in the market; but we believe this allows businessowners to see and assess the options available to them much faster and therefore improves transparency in an industry that has historically been the victim of slow and ambiguous processes.