Chirag Shah, Senior Vice President, Fintech & Innovation Lead, Publicis Sapient

More than ever before, technology is critical to the success of financial institutions. Over recent years, we’ve started to see fintech and incumbent tech compete, as there has been increased demand from consumers. With everyone having to operate remotely due to COVID-19, the customer needs, and therefore, the companies’ urgency to act quickly, have been accelerated.

Banks and financial institutions must show their ability to develop new customer friendly innovations that can help connect data and high-end digital delivery. Here are some innovative technology trends that will help navigate the disruption.

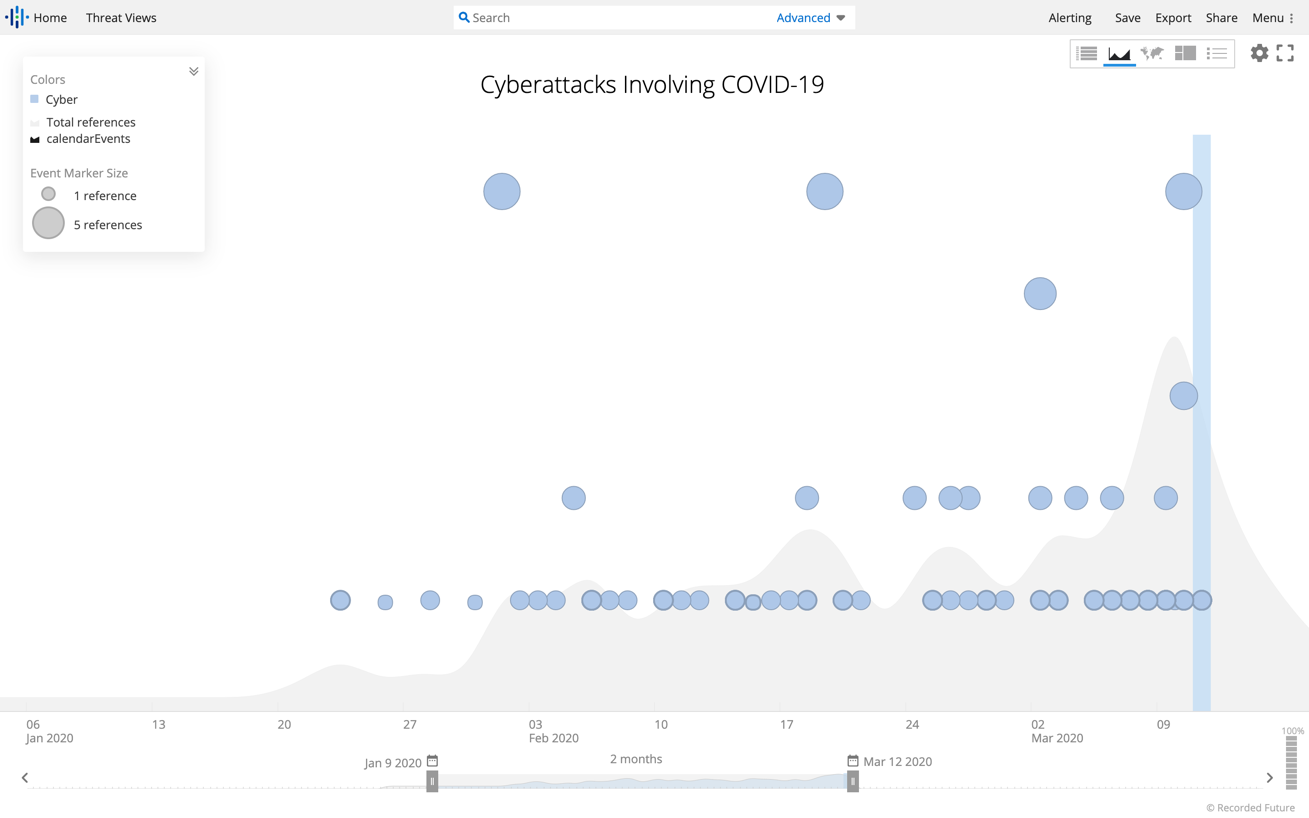

Cybersecurity

Since the onset of the pandemic, cyberattacks have rapidly increased. People are extensively utilizing online platforms for their professional and personal needs. Often times they are using their personal devices, rapidly shifting transaction patterns and with limited control on access privileges it has put an enormous stress on security controls.

Given the distributed nature of work is something we will continue to face in the near term, organizations will need to focus on security measures across infrastructure, product and people. There are several recommendations to get in front of cyber-attacks:

- Building robust resilient products

- Instituting stronger access privileges across application, data and network stacks

- Patching hardware and software with the latest security updates

- Building cloud native products which have inherent tighter security controls

Resiliency

Since March, we have been forced to accelerate the pace for innovation around technology themes such as application modernization and rationalization. Companies have to transform digitally so they can scale up digital products and services and they need to migrate legacy technologies onto modern platforms.

Critical financial service platforms such as brokerage trading, commercial lending, customer analytics and call-center operations are being modernized with latest technologies that are virtual, scalable and federated. The impact around how these components react and work with each other in the scenarios of highly volatile environments is unknown. Recent troubles have shined a light on the vulnerability of critical platforms and the necessity for new tools and processes that ensure they will stay competitive. Ensuring modern distributed applications work, with mainframe like reliability and cloud like scalability, is Resiliency.

Low Code No Code Platforms

Digitization driven by recent events will need enough acceleration to support customer’s behavioral transformation. Low Code No Code platforms will thus emerge as a winner as it enables a rapid turnaround in designing and building applications with minimal hand coding and delivering value in an agile and reliable manner.

According to Gartner, “by 2024, three-quarters of large enterprises will be using at least four low-code development tools for both IT application development and citizen development initiatives. By 2024, low-code application development will be responsible for more than 65% of application development activity.”

Data’s new defined purpose

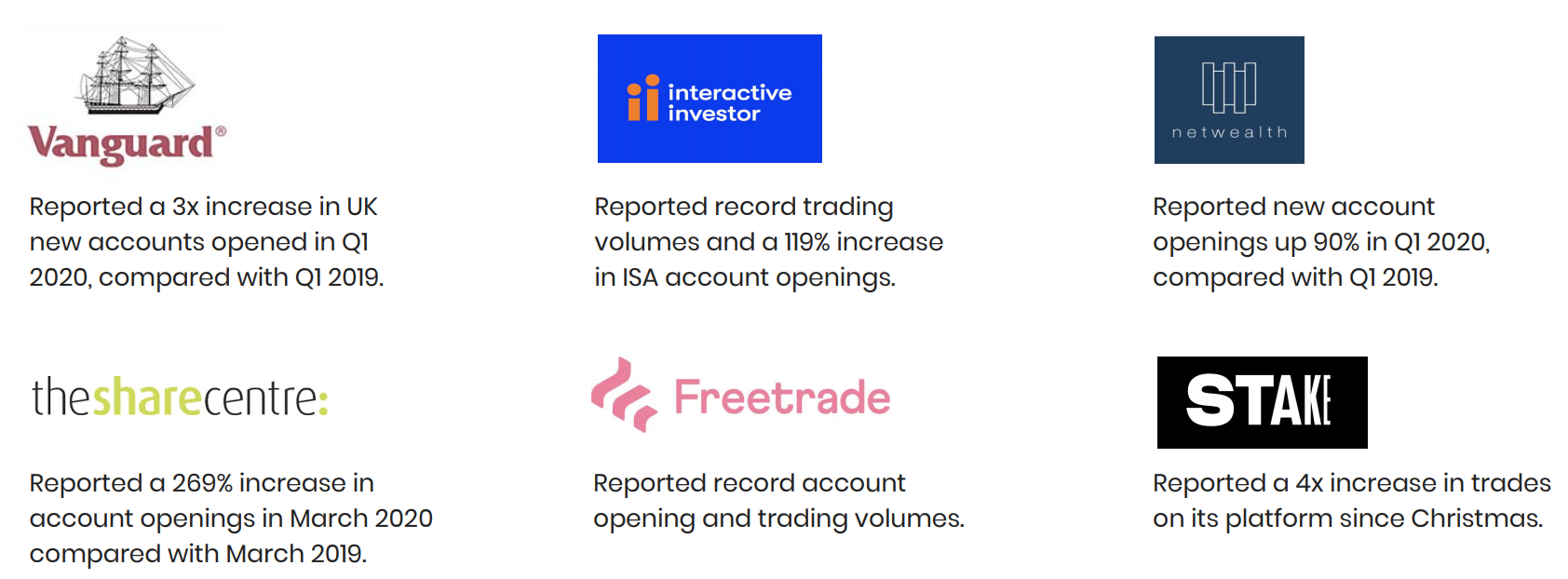

Democratization of data will be a key initiative within every financial service client particularly if they want to restructure their products and make them digitally available to customer. Evident from the below examples, increased customer activities across digital channels has created massive datasets.

Gathering critical information sets relevant to the business and customers will democratize data. Three strategies which will help financial service organizations be more data-driven:

- Proliferations across these massive data sets produced by customers and other channels will define new rules and expectations to create a customer 360 view.

- Adopting and implementing the new Data privacy, Data governance and Data practices.

- Data driven decision making through visual analytics and data story telling.

We are now starting to see that alternate data sources are being leveraged, in the Investment Research processes, in order to track retail sales. As an example, gun sales spiked right before COVID, and historical transactions data tied to geo-location data, can inform hypothesis of what companies selling firearms could have a spike in revenue.

Artificial Intelligence

Banks are starting to invest more in leveraging AI models to help prevent credit loss. Post COVID-19, banks are unable to identify who is creditworthy. Credit reports are unable to accurately reflect where borrowers have deferred making payments to lenders across multiple months. AI can be leveraged to better service banks to identify potentially delinquent clientele. Based on customer profile, banks will have to react appropriately:

- New customer acquisition – Suppress marketing to increased risk customers, as pre-approved customers may have lost their buying power, which isn’t reflected in the credit reports

- Pre-delinquent customers – Early warning and early intervention to identify struggling customers

- Post-delinquent customers – Identify and suggest hardship programs to help reduce risk for customers that might have lost their jobs or being furloughed

Remote working has proved challenging for front office workers and their typical access to information flow. Chatbot usage is rapidly increasing as they use natural language processing to connect into multiple underlying systems in order to provide a one stop shop for all information to the investment professional (IP) leveraging collaboration tools like Symphony. This allows data sharing with other IPs and access to data from multiple systems at their fingertips.

Additionally, call centers are utilizing AI/chatbots to help augment the inbound calls to see if a virtual assistant is able to answer straight forward customer queries.

Banks and financial institutions no longer have the luxury of staying complacent with the legacy tech, or waiting to see what trends prove to be most effective before investing. Financial institutions need to be taking action, embracing the changes they have faced already, and the ones they have yet to encounter and they should be bullish in investing in technology that will help them disrupt competitor business models, in order to help them stay afloat during these unprecedented times.