- Stocard, the leading European mobile wallet with over 50 million users, launches its payment functionality, Stocard Pay, in Germany, France, Italy and the Netherlands

- The payment feature is the first financial service launched by Stocard and is the first in a series of new major features planned in the upcoming months

Stocard, the leading European mobile wallet, today launches its payment feature Stocard Pay in four European countries: Italy, France, Germany and the Netherlands having launched in the UK in June this year. This latest announcement from Fintech company Stocard is the first of a series of features as it sets its sights on becoming the leading on-the-go financial services provider.

Stocard Pay is the latest feature from the Stocard app as it looks to expand its mobile financial services across the continent having already seen huge success with its original offering that allowed shoppers to manage all their loyalty cards in one app launched in 2012. The fintech company now has over 50 million customers and 1.7 billion POS-transactions per year and is now looking to expand its offering to provide a holistic approach to consumer financial services.

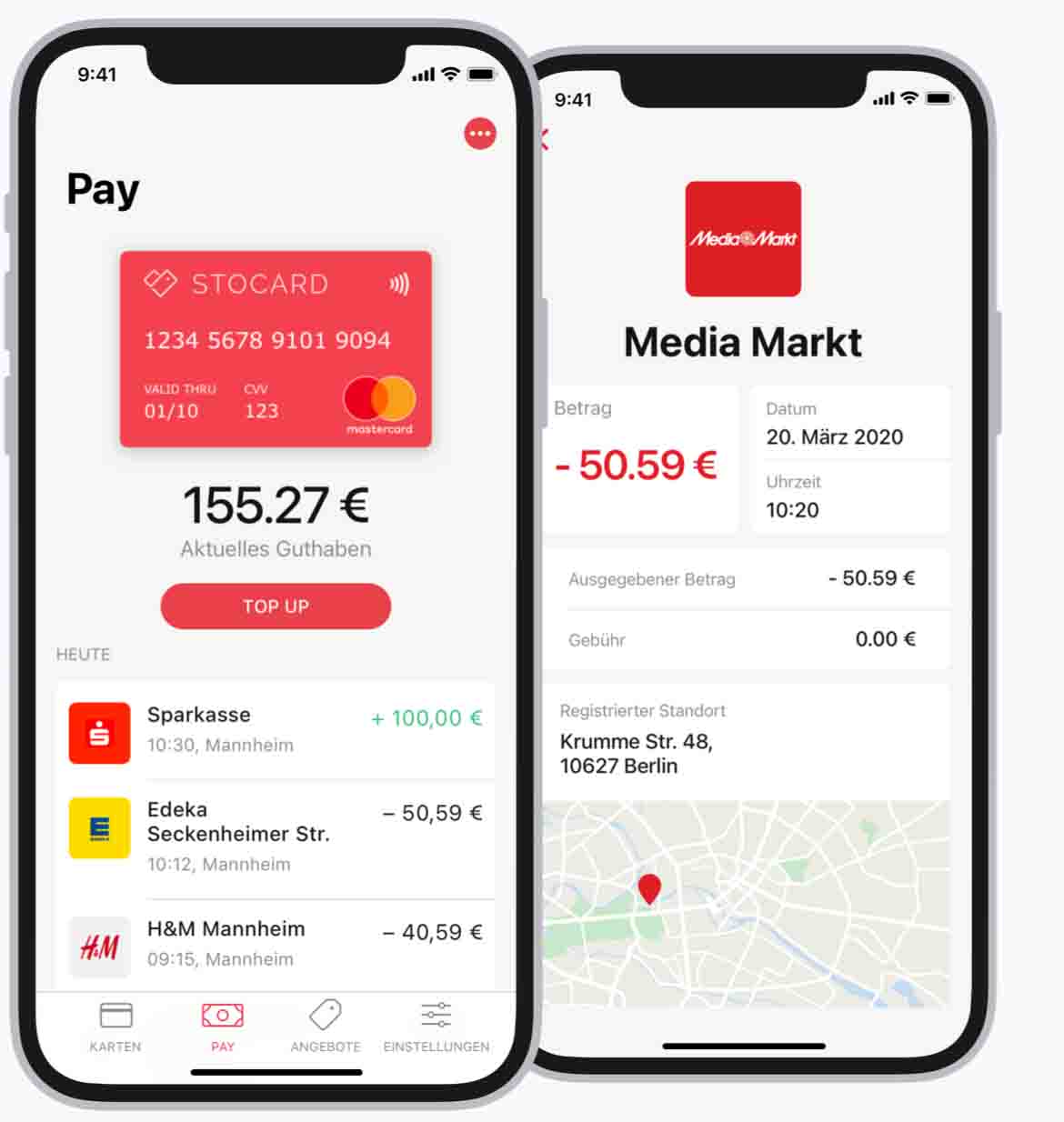

The new feature was developed to complement the end-to-end shopping experience that the existing Stocard app offers by adding multiple bank cards to the app. Stocard Pay allows users to create a virtual credit card hosted in the app. Registration is seamless taking just one minute and without the need for paper documents. Users currently can top up Stocard Pay using Mastercard and Visa and allows users to save on foreign currency fees when purchasing items abroad.

Android users have access to the virtual card directly in the Stocard app. For iOS devices, Stocard supports Apple Pay, which brings the Stocard payment card to Apple Wallet. Users simply transfer money to their Stocard account from their bank account or by using their debit and credit cards. Thanks to the auto-top-up function, users don’t have to reload their account manually, instead the Stocard account can be refunded automatically once the balance drops below a certain threshold.

Björn Goß, CEO and co-founder of Stocard, comments: “The launch of Stocard Pay in four more European markets is a major step for us to bring the future of banking to our users. The digital wallet is becoming the central hub in our lives for everything around money, shopping, and banking.

“We see the future of banking as purely mobile and working in conjunction with other financial services in one easily accessible place. Stocard Pay is the first major feature with several more planned over the next months as we create this future of shopping and banking through Europe’s leading mobile wallet for everyone.”