From Brandenburg to Malibu, climate change is making the headlines. Heatwaves, floods, hurricanes, droughts, wildfires across the globe and thousands of humans, animals and trees have disappeared. Despite clear signs from the planet, climate change is not a very manoeuvrable concept for individuals, and it has not caused the political reaction needed to curb this impending disaster.

The ever-increasing cost of not managing climate change

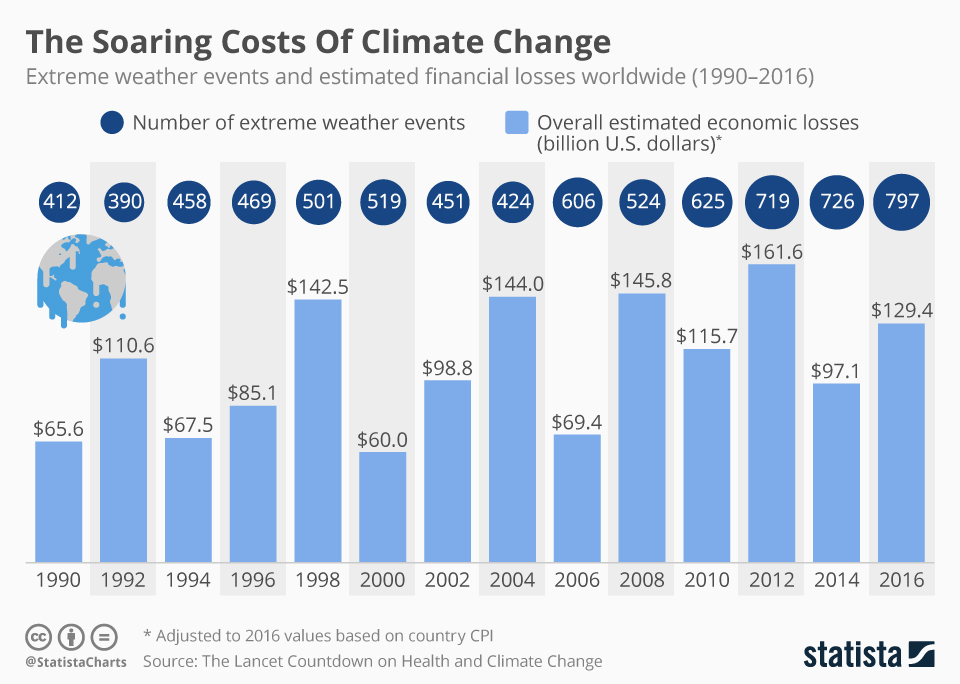

Beyond catastrophic headlines, the cost incurred for real estate, supply chains insurance franchises, private citizens and companies have grown exponentially. According to Penn State University’s research, there is an exponential relationship between temperature change and costs incurred to the global economy.

Both the number of extreme weather events and the price tag on the economy has almost doubled in 10 years. (Credit: Statista)

In 2017 in the US alone, natural disasters have cost upward of $330 billion. This is twice the average amount of the previous 10 years.

In this context, initiatives to mitigate the consequences of this already palpable change have met with increasing success. Danielle Logue, Professor in Innovation, Entrepreneurship and Strategy, University of Technology Sydney explains:

“Market infrastructure is emerging to support the growth of impact investing globally. It is estimated the impact investing market will be worth between US$650 billion and US$1 trillion in the coming decades.”

The private market is adapting to climate change. Corporate Social Responsibility is growing out of its initial niche to become a self-standing business argument. Companies such as Patagonia, Ikea or Vaude in Germany have made sustainability one of the pillars of their 21st-century business strategy.

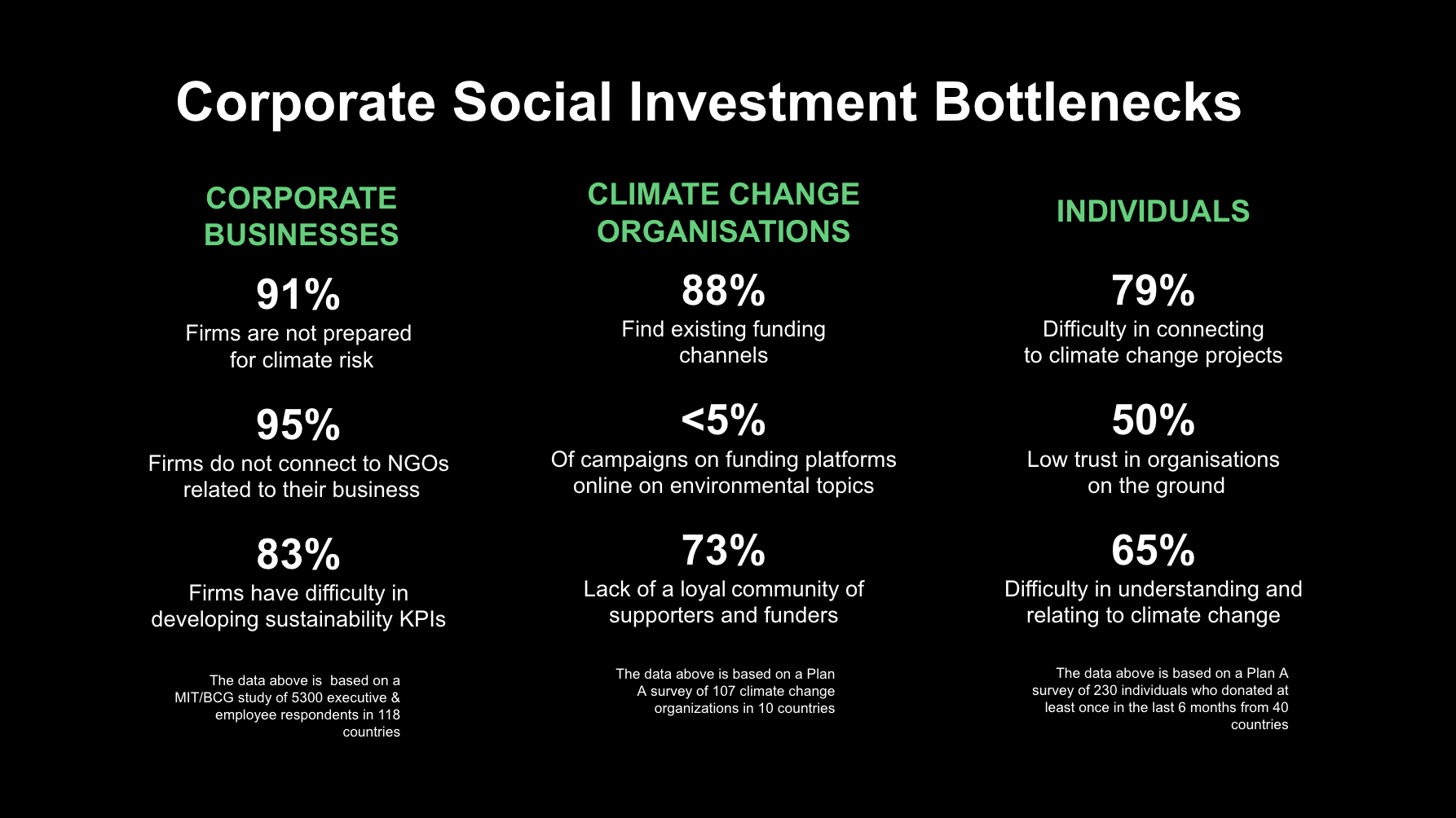

Both small-size and larger-scale companies are looking for avenues to support climate action that is in line with their clients and sales strategy. On the other hand, individual and collective projects tackling climate change from all angles are looking for patrons and support from the community. One of the greater bottlenecks of green investment is the gap between these two worlds.

New customers, new goals, new channels

Plan A, a Berlin-based startup, has created a platform for individuals, businesses, NGOs and governments to act together, informed by the facts and the data. This social impact company has developed an algorithm to predict where and how climate change is going to hit the hardest. With this information, this company match-makes the most critical sustainability projects with conscious businesses and a network of environmentally aware supporters. The platform has launched on the 20th of December with 60 climate action projects in 50 countries.

2019 will be the year of conscious investment. As the first Superbowl ad teasers seem to confirm, companies are striking the conscious chord of their customers. In a recent survey conducted by Yale Program on Climate Change Communication and the George Mason University Center from Climate Change Communication, a record 72% of Americans declared that climate change was a personal concern of theirs. This represents a 10% increase from the last measure in 2015.

https://www.youtube.com/watch?v=UKDA2HVlgko

It is only normal then, that environmentally conscious customers, increasingly numerous with each generation, possibly more affluent and representing a new form of business loyalty based on values, become the primary target of brands looking to figure prominently in the post-millennial era. These companies also know that greenwashing, or the “the practice of making an unsubstantiated or misleading claim about the environmental benefits of a product”, can backlash pretty badly. If a company is going to support climate action or another social cause, it will be held accountable to the effects of its campaign. In other words, to look good, you need to do real good.

The Importance of being Earnest

Companies like www.plana.earth that are able to curate accurate climate action for positive businesses are already central in the twin fights for customers and against climate change. Some businesses like Apple or Starbucks seem to have gotten sidetracked from their respective approaches to driving social impact and building a regarded as a positive force for change. The days when these companies seemed like a viable option against the “bad” businesses against which they were up against are long gone.

With the ushering of digital finance, from mobile payments in East Africa to direct support from social media channels, opportunities arise to invest more and engage more deeply with new partners. Non-governmental Organisations, entrepreneurial changemakers designing solutions perfectly adapted to their needs and settings, or committed consumers who evaluate marketing programs more closely than ever are all examples of the existence and growth of a demographically and culturally dominant conscious market. It’s time this came out in the public: Nice guys are more popular than bad boys.

Nathan Bonnisseau is currently Head of Content and Marketing at Plan A, the first data-driven crowdfunding platform in the fight against climate change. He has previously honed his marketer and fundraising skills for French and US education institutions, as well as his content creation game for various publications. The only thing he likes more than cooking good food is eating good food. But if he had to choose, he’d probably bring his guitar over his spatula on a desert island.